The big local housing story today is a study that was released recently by University of Washington Economics professor Theo Eicher. The thrilling title of the study is “Municipal and Statewide Land Use Regulations and Housing Prices Across 250 Major US Cities,” and it may be found (along with a number of related materials) here.

Rather than just quote the news articles about the study, let’s take a look at the study directly for ourselves. Unfortunately, most of the study is exactly what you would expect from a university economics professor: lots of confusing terminology and complicated math concepts. I’ll do my best to accurately summarize his findings here.

Before we get started, two important factors should be noted. First, that according to the Times write-up, Mr. Eicher “received no outside funding for the project.” So there is no basis to suspect he was influenced toward a specific conclusion by any particular outside interests. Second, the study focuses only on “owner-occupied” housing within the actual city limits.

Here’s the question Mr. Eicher attempts to answer with his study:

What drives the change in housing prices?

Or: Did housing prices increase because of land use restrictions and/or income/population growth?

In order to answer that, he breaks down the components that affect housing price growth in any given city into the following:

- common effects*

- land use regulations

- income

- population

- population density

*(Such as changes in the national level of unemployment, changes in mortgage rates, or lending procedures, or liquidity in the mortgage market.)

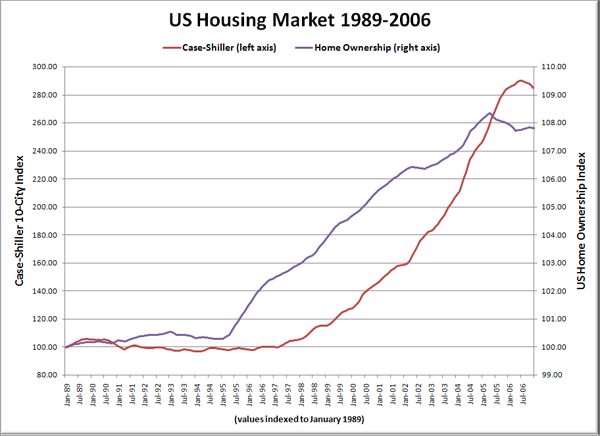

He goes into quite a bit of detail on the effect of each of these factors on housing prices, and the end result is a large table (Table 3) in which he puts a dollar amount on the amount of change due to each variable from 1989 to 2006. The big number that the news reports are attaching to is the total estimated contribution of regulation, which he calculates at just under $200,000 (in 2006 dollars) for Seattle.

Considering what a large percentage of the total increase that $200,000 makes up, it is no wonder that’s what the news is focusing in on. However, in looking at Mr. Eicher’s results, the thing that jumps out to me is that the estimated contribution of the common effects mentioned above is somehow negative over the time period he studied. Unfortunately I couldn’t find a detailed explanation for this in his paper, although I admit that it would probably take me a couple days to look over it thoroughly enough to say that for sure that there isn’t one. It would seem to me that changes in mortgage rates (much lower in 2006 than 1989), lending procedures (much looser in 2006 than 1989) and mortgage market liquidity (much greater in 2006 than 1989) would have a pretty large positive effect on home prices, not a negative one.

Furthermore, while an analysis like this may accurately describe the effect of regulation on the cost of new homes, I would contend that the cost of resale homes is not necessarily always directly tied to the cost of new construction. Yes, the two are related, and there is likely a strong correlation when the housing market is strong and homeownership is increasing. But that’s the problem; during the entire time period Mr. Eicher studied, homeownership was steadily increasing, and for most of the period, housing markets were relatively strong.

I’m not going to try to argue with Mr. Eicher’s obviously well-researched study. If he feels that he has convincing proof that regulations have been that major of a factor in home prices, then those of us without advanced degrees in economics will probably have to take him at his word. However, I think it’s reasonable to ask whether this apparent relationship between government regulations and home prices holds true regardless of overall demand for home ownership. 2006 was essentially the peak of a very long run-up in the housing market. It will be interesting to see if regulation keeps prices propped up as demand drops like a rock.

(Theo Eicher, University of Washington, 01.14.2008)

(Elizabeth Rhodes, Seattle Times, 02.14.2008)

(US Census Bureau, Homeownership Rates)

(S&P/Case-Shiller, Home Price Index)

Update: The Sightline Institute, a green-minded “think tank,” has their own rebuttal of the study up on their blog. It’s interesting, but unfortunately the post seems based entirely on Elizabeth Rhodes’ article in the Times, and not the study itself. As I said above, my two biggest problems are that the study alleges a negative influence on home prices due to the mortgage market, and that the time period encompasses only a relatively strong period of growth for the housing market. None of the other people complaining about this study seem to be hitting on those important points.