Incredible. Even with the major continuing job losses and home prices in unabated decline, Matthew Gardner continues to spread the word of a recovery for Seattle in 2009.

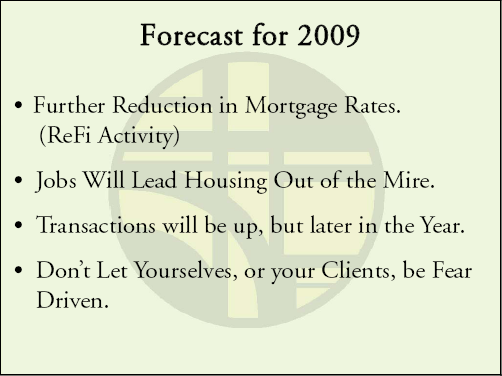

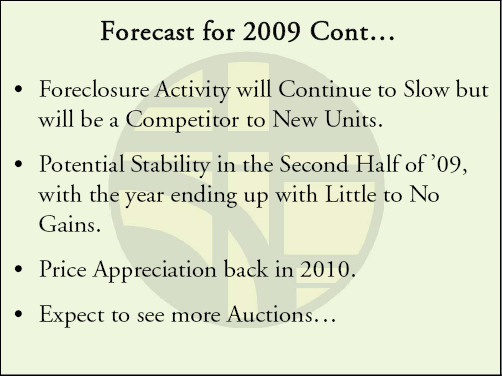

Here are a couple of slides from a PowerPoint presentation Matthew Gardner used in a class for local real estate agents on the 19th:

Jobs will lead to a housing recovery in 2009? Really? And how exactly are foreclosures going to “continue to slow,” when the latest data shows that they haven’t even started to slow?

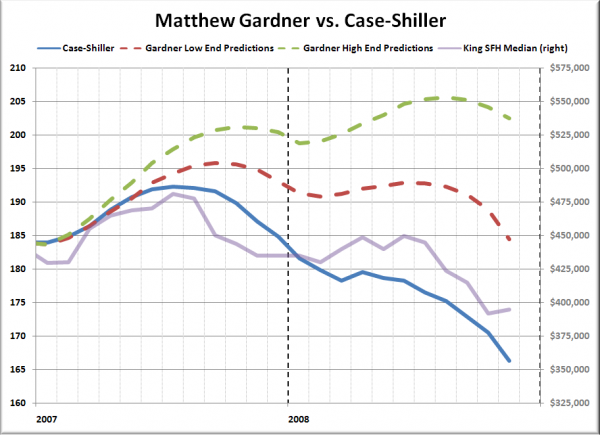

Let’s take a look at Matthew Gardner’s recent performance when it comes to accurately forecasting the local market…

2007

Gardner Forecast: Prices +5 to +9%

Case-Shiller: +0.5%

King Co. SFH: -1.1%

2008

Gardner Forecast: Prices 0 to -5%

Case-Shiller: -11.2% (Nov.)

King Co. SFH: -7.2%

Here’s a visual representation of Matthew Gardner’s predictions for 2007 and 2008 vs. the Case-Shiller index:

Like I said about J. Lennox Scott and Dick Beeson: I’m not going to tell you who you should or shouldn’t trust when it comes to predictions about the local housing market, but I do think everyone should at least be equipped with all of the data when making such a decision.