Just-released data on open house traffic, phone calls placed to realtors, and casual searches at online listing sites, all point to a single, undeniable conclusion: April 2010 is the bottom of Seattle’s minor real estate adjustment.

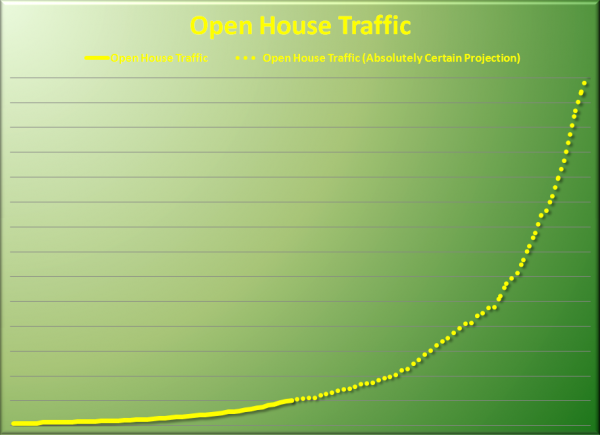

Look at this highly reliable chart of OPEN HOUSE TRAFFIC©®™ sent to me by a trustworthy leading industry representative:

Just look at it. How can anyone deny the undeniable power of rapidly-increasing foot traffic in open houses? You can’t, so don’t even try.

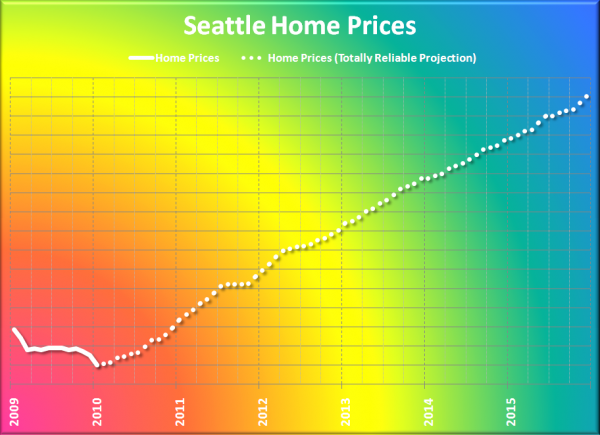

And obviously, what does skyrocketing OPEN HOUSE TRAFFIC©®™ lead to? Inevitable and immediate recovery in prices, of course! Here is a just-released home price projection from the industry’s leading professional association:

Amazing, isn’t it??? Clearly anyone who does not jump into the housing market THIS VERY MINUTE is a complete and utter fool. A moron with maggots for brains.

Still don’t believe me? Look at this chart, which shows the undeniable effects of the expiring tax credit, the impending explosion of interest rates, and home prices shooting through the roof.

If you buy today, you can get the house you want and still have $100,000 left in the bank for a new Hummer (I hear they’re going to be collector’s cars soon!) or a vacation to Paris or something. BUT IF YOU WAIT, the purchasing power of your money drops dramatically while simultaneously the price of even a mobile home in Sultan becomes out of reach within just a few months.

You read it here first, folks. Buy now or be sorry!!!