I’m hoping the readers of Seattle Bubble can help me out with something.

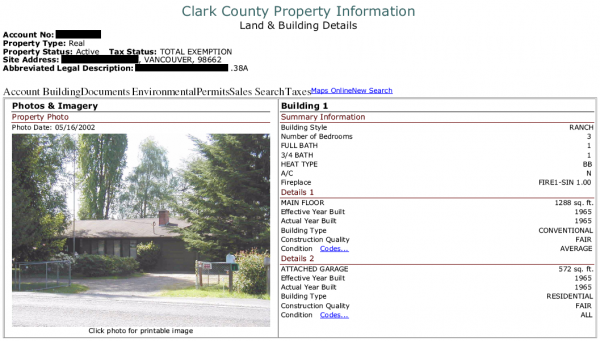

First, a little background on my perspective. My parents bought their first house in 1987, when they were about 30 years old. They paid $45,000 for the modest 1,288 square foot, 3-bedroom, 1.75-bath house pictured below.

They refinanced once in the ’90s to get their ~10% rate down to around 7%, payed extra on the mortgage whenever they could, and paid the house off entirely in 2007. They would still live there today if Clark County hadn’t bought them out in 2008 to re-route the neighboring high school’s driveway and put in a retention pond. With the money the county paid them for their house they found another house that they could pay cash for.

By their early 50s, my parents were completely mortgage free. Their only housing expenses are property taxes, utilities, and maintenance. In my mind, this is one of the biggest benefits of buying a home—the ability to eventually pay off the mortgage and dramatically reduce your cost of living.

However, today it seems that everyone I know or hear about has little to no intention of ever actually paying off their mortgage. The typical home buyer’s process seems to look something like this:

- Buy a home.

- Live there for 3-10 years.

- Get the urge to move up the “equity ladder” to something bigger.

- Go to step 1 (and get a whole new 30-year mortgage in the process).

By the time someone has finally “settled down” and stopped moving to a new home and starting a new 30-year mortgage every few years, they’re probably as old as my parents were when they paid off their mortgage.

If you’re stuck in this loop, can that really even be called home ownership? Aren’t you just perpetually renting money from the bank and paying 6% to the real estate industry every few years to support your nomadic lifestyle? How is constantly resetting to a new 30-year mortgage any less “throwing away money” than renting (especially when, during the first five years, nearly 80% of your mortgage payments are applied to interest, not principal)?

Does anyone pursue actual home ownership anymore, or are most people just interested in home buying and perpetual debt? I’m genuinely curious. Do you or the people you know think of home ownership in terms of buying a home and eventually paying it off, or are you more focused on climbing the equity ladder until you retire?