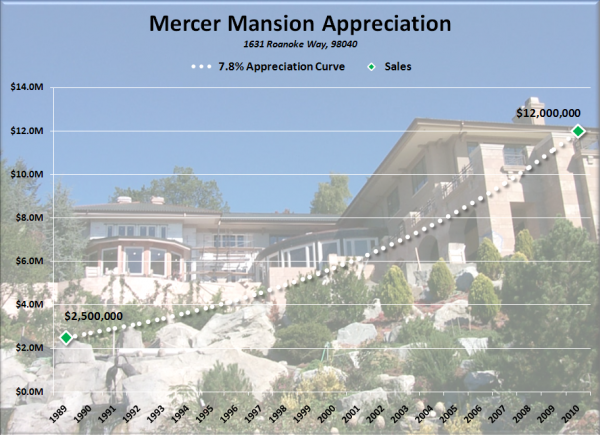

The Puget Sound Business Journal and the Seattle Times both spent some print this weekend on the tale of a mega-mansion on Mercer Island (1631 Roanoke Way, 98040) that sold last month for $12 million.

Of course, the angle of most of the local press I saw on the sale was the big “discount,” of the home, which was originally listed way back in 2004 for a cool $40 million. I thought I’d take a slightly different look at the story.

So what we have here is a prime piece of lakefront real estate—1.5 acres—on Mercer Island with stunning views of the lake and the Olympics. Definitely qualifies as the kind of land they’re “not making any more” of. On this land, we’ve got a 23,000 square foot mansion. The kind of home that people buy when money is really no object.

During the time it was up for sale, although it was not (as far as I can tell) listed on the MLS, it did receive a nearly endless stream of free press, with story after story after story after story after story after story after story gushing about the home. Oh, and did I mention that after purchasing the home for $2.5 million in 1989, the previous owners did a multi-million-dollar remodel in 2001 (the 2006 Wall Street Journal article refers to “their recent eight-figure investment”), nearly tripling the home’s original size?

So what kind of long-term appreciation rate does the combination of super-exclusivity, gobs of free advertising, and the mother of all home improvement projects get you? 7.78%, apparently.

Personally, given the above factors, I would consider 7.78% to be something of an absolute ceiling on what one would expect for long-term appreciation on a more average home in the Seattle area. In fact, given the massive size of the remodel, I’d say it’s probably safe to assume that half or more of this home’s appreciation is due to the increased size of the home.

Just something to keep in mind as you’re house shopping. Many Seattle-area homes may be cheap today compared to 2007, but they’re often still a bit overpriced compared to a reasonable long-term appreciation rate of 3-4%.