As January 2011 fades into the distance in the rear view mirror, it’s time for another monthly stats preview. Most of the charts below are based on broad county-wide data that is available through a simple search of King County and Snohomish County public records. If you have additional stats you’d like to see in the preview, drop a line in the comments and I’ll see what I can do.

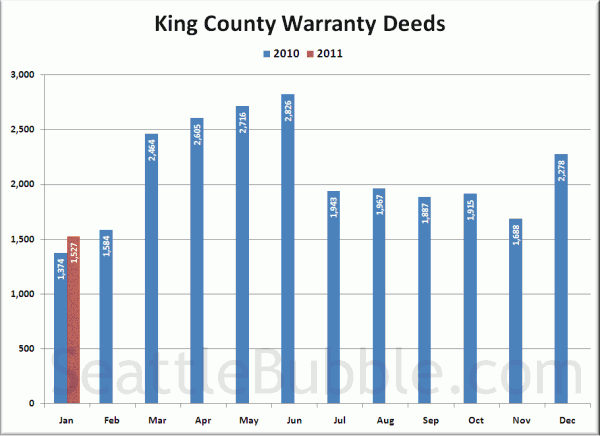

First up, total home sales as measured by the number of “Warranty Deeds” filed with King County:

Warranty Deeds dropped back down 33% in King County between December and January, falling to the lowest level since January last year. Last year Warranty Deeds fell 37% during the same month. YOY Warranty Deeds were up 11%. Based on this data, assuming no shenannigans, we should see NWMLS-reported SFH closed sales for January fall to just below 1,000.

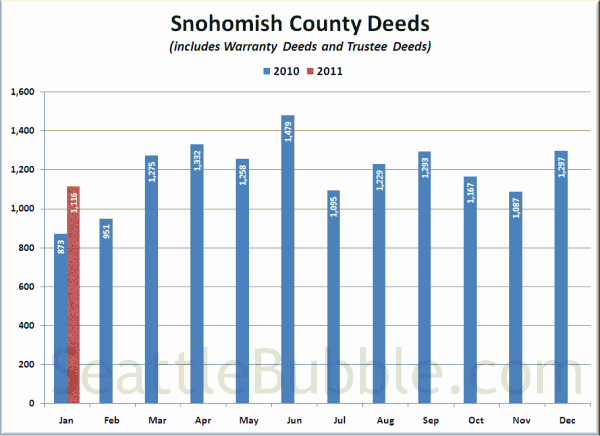

Here’s a look at Snohomish County Deeds, but keep in mind that Snohomish County files Warranty Deeds (regular sales) and Trustee Deeds (bank foreclosure repossessions) together under the category of “Deeds (except QCDS),” so this chart is not as good a measure of plain vanilla sales as the Warranty Deed only data we have in King County.

Overall deeds fell less in Snohomish, but since this includes foreclosure sales, it’s hard to know what’s going on with regular sales volume.

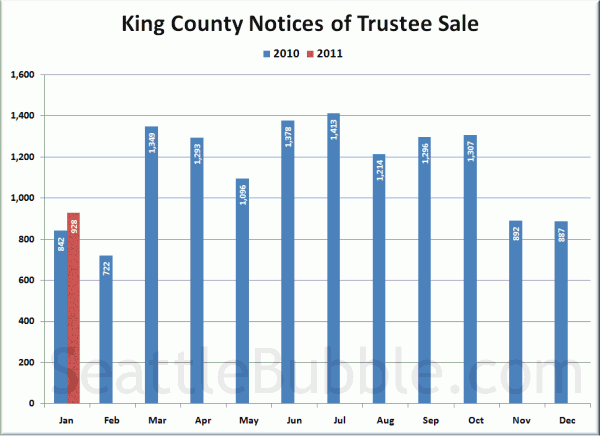

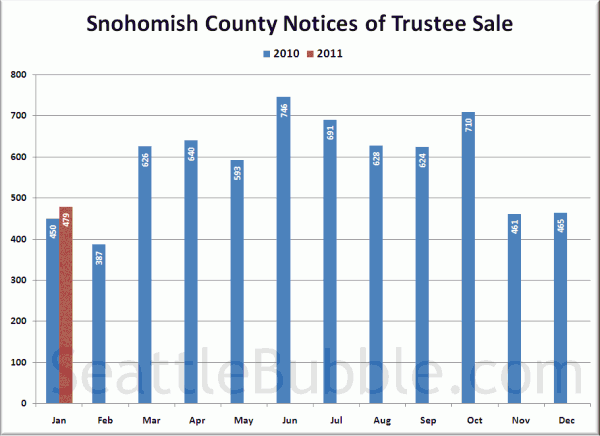

Next, here’s Notices of Trustee Sale, which are an indication of the number of homes currently in the foreclosure process:

Both counties were up slightly MOM and YOY.

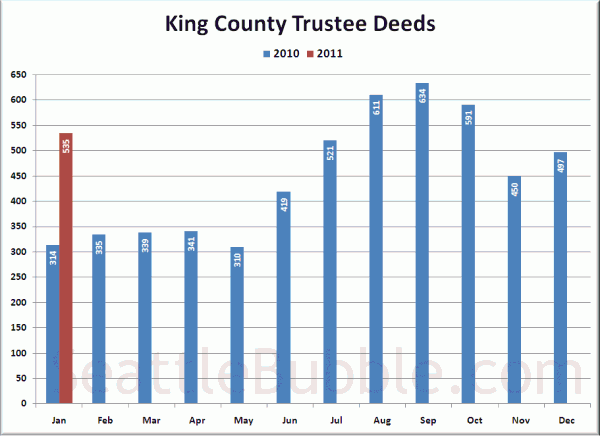

Here’s another measure of foreclosures for King County, looking at Trustee Deeds, which is the type of document filed with the county when the bank actually repossesses a house through the trustee auction process. Note that there are other ways for the bank to repossess a house that result in different documents being filed, such as when a borrower “turns in the keys” and files a “Deed in Lieu of Foreclosure.”

Up 8% month-over-month and 70% year-over-year.

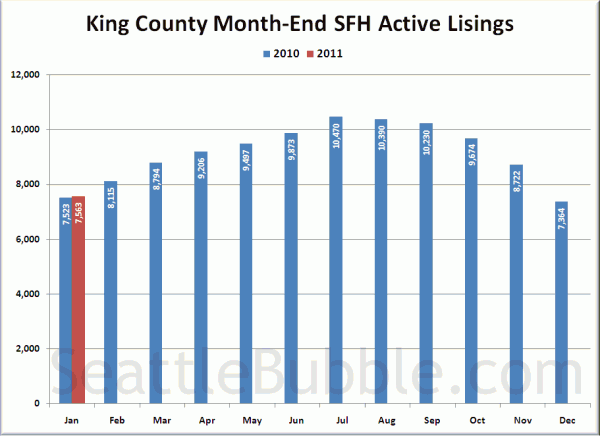

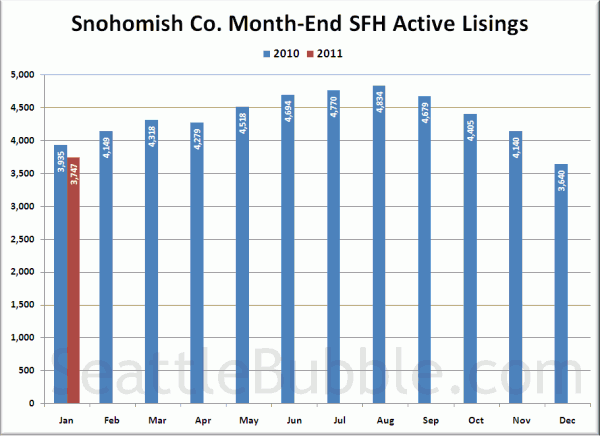

Lastly, here’s an approximate guess at where the month-end inventory was, based on our sidebar inventory tracker (powered by Estately):

If these estimates are correct, it looks like the dearth of new listings I mentioned earlier this month is starting to put some downward pressure on overall inventory, especially up in Snohomish County.

Stay tuned later this month a for more detailed look at each of these metrics as the “official” data is released from various sources.