It’s been a while since we posted Round 2 of our Guess the Price contest, and with entries closed and five (count them, five) price drops since the contest began, I thought it would be nice to have a quick checkup.

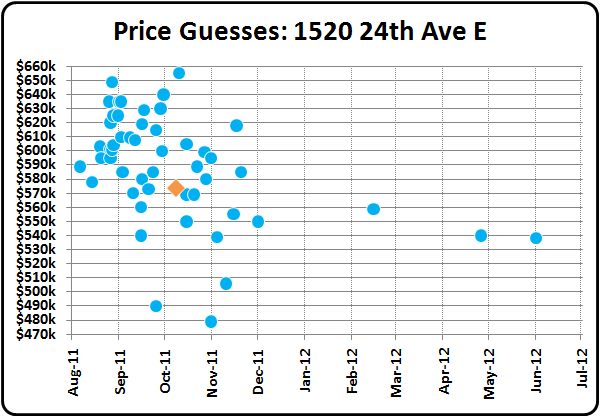

In the chart below I have plotted each of the fifty-two guesses by readers in this contest as a blue circle. The orange diamond is where the home would close if it went pending with a full-price offer today and closed in thirty days.

Thirty-five of the fifty-two guesses in this contest were higher than the current asking price. The tiny size of the latest price drop (only $1,500—0.3%) implies that the seller is getting close to their bottom line price, but they’re still at $200,000 over what they paid for the home pre-remodel in April, and I doubt their work cost that much.

It would appear that the cons on this home may be outweighing the pros for potential buyers of this remodel. I guess there is only so much that a stainless-steel, six-burner range can do to offset cracks in the basement, a sloped yard, and a busy street. Here’s hoping (for the sake of wrapping this contest up) they find a buyer before the market goes into winter hibernation.