In the comments on yesterday’s post, reader “Topdog” posed the following question:

So the Fed stops playing funny money, lets interest float to market rate. Lets say a reasonable 3% premium plus the 3% inflation premium which puts high quality new mortgages at about 6%. How does that affect buyer affordability?

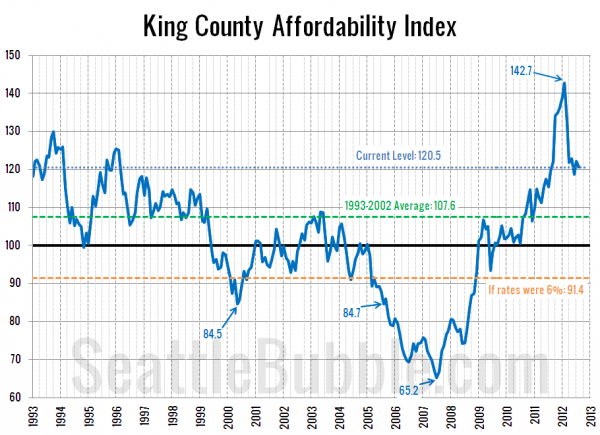

That’s a question we have addressed on these pages before, but it has been a few months since the last update, so here’s the latest chart of the affordability index, along with an indicator of where we would be if mortgage interest rates rose to 6% but home prices and incomes stayed at today’s levels.

If interest rates suddenly jumped to 6%, affordability would drop below the pre-bubble average, but would actually still be better than it was through the worst of the bubble between 2005 and 2008.

Of course, everyone has been predicting that interest rates will rise for at least the last three years, all while they have continued to drop. Eventually they will go up, but it will probably be a gradual climb, and by the time they get to 6%, incomes will also be higher. Barring another real estate bubble, I doubt we’ll see the affordability index drop below 100 in the next few years, or even when rates do finally start to go back up.