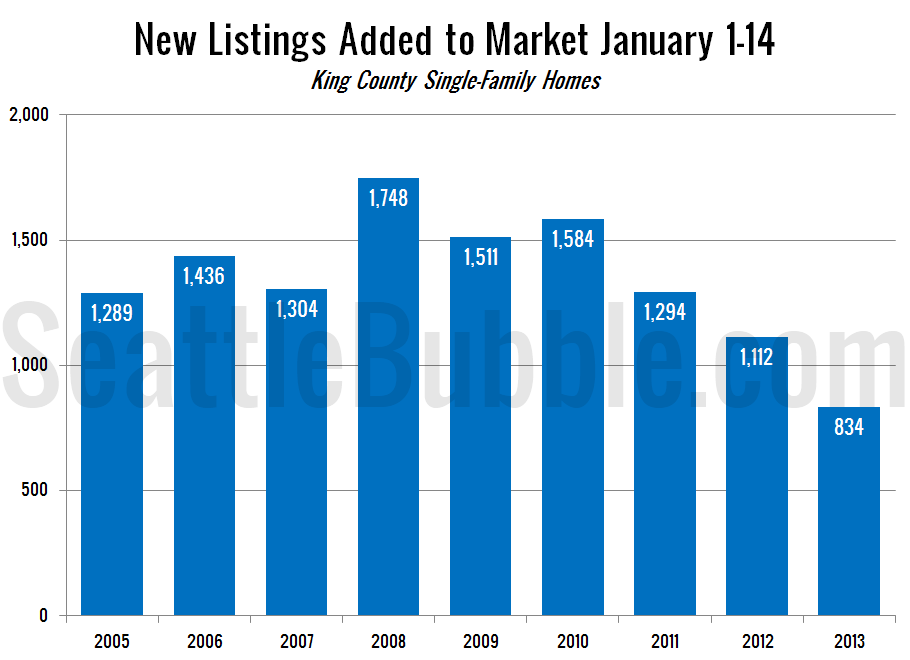

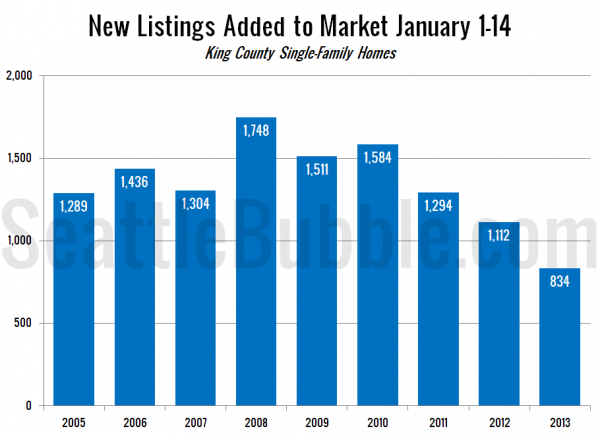

Well, this is just depressing:

After the first two full weeks of the year, new listings of single family homes in King County are down 25% from last year. This follows a 14% drop last year and an 18% drop the year before that.

For buyers who were hoping that the new year would bring some relief from the problem of sparse selection, this is extremely unwelcome news.

I had hoped that last year’s strength would convince more of the homeowners with “pent-up supply” to list their homes this year, but so far that is definitely not the case.