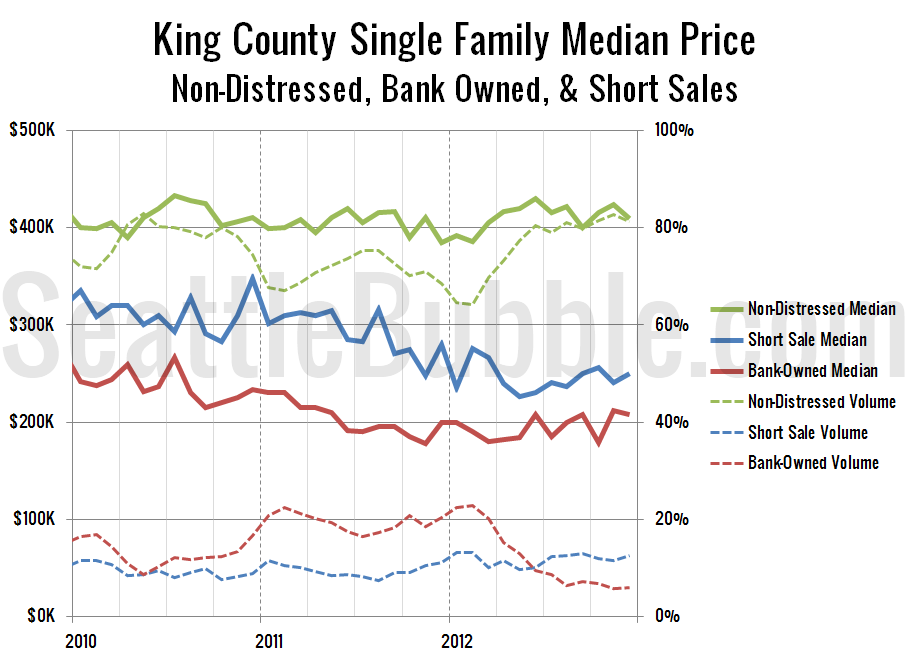

As promised on Wednesday, it’s time to check up on median home sale prices broken down by distress status: Non-distressed, bank-owned, and short sales.

As of December, the non-distressed median price for King County single family home sales sits at $409,475, up 6.5% from a year earlier.

An increase of 6.5% year-over-year is pretty strong, and makes me wonder whether December saw another shift of sales away from the cheaper parts of the county and toward the more expensive regions. We’ll take a look at that next week.

The bank-owned median sale price was at $208,000 in December, up 4.0% from a year earlier. The short sale median price came in at $250,000 in December, down 10.7% from 2012.