Let’s take an updated look at how King County’s sales are shifting between the different regions around the county, since geographic shifts can and do affect the median price.

In order to explore this concept, we break King County down into three regions, based on the NWMLS-defined “areas”:

- low end: South County (areas 100-130 & 300-360)

- mid range: Seattle / North County (areas 140, 380-390, & 700-800)

- high end: Eastside (areas 500-600)

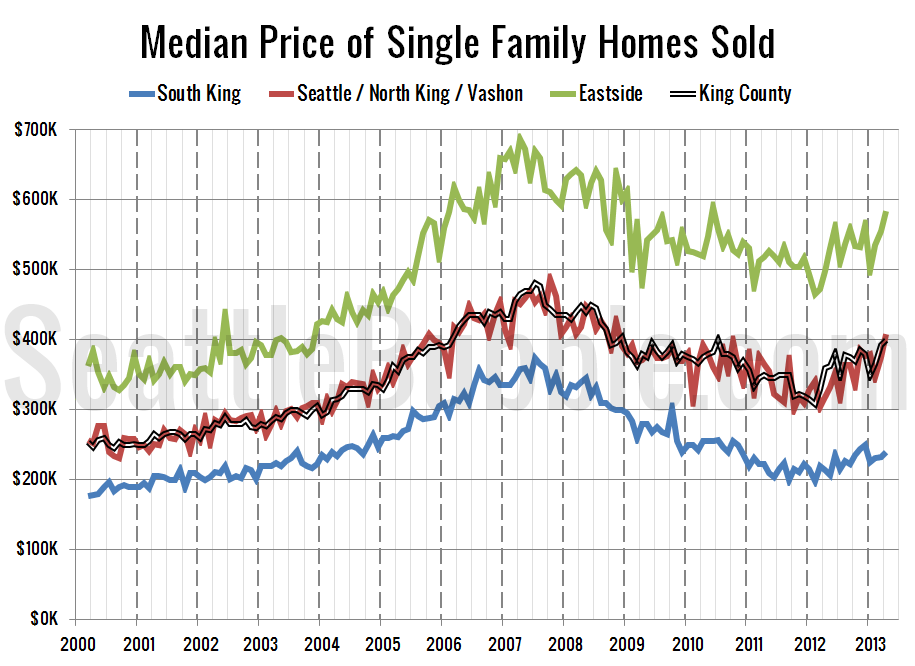

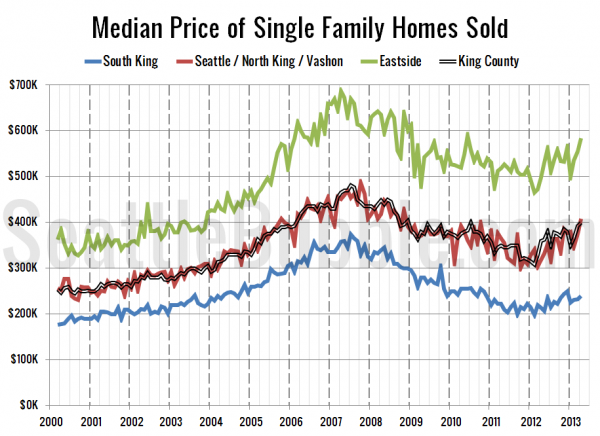

Here’s where each region’s median prices came in as of April data:

- low end: $208,000—$328,975

- mid range: $318,000—$631,000

- high end: $465,000—$1,240,000

First up, let’s have a look at each region’s (approximate) median price (actually the median of the medians for each area within the region).

The median price in the low end regions inched up, while median in the high and mid-tier regions both saw another sizeable bump in April.

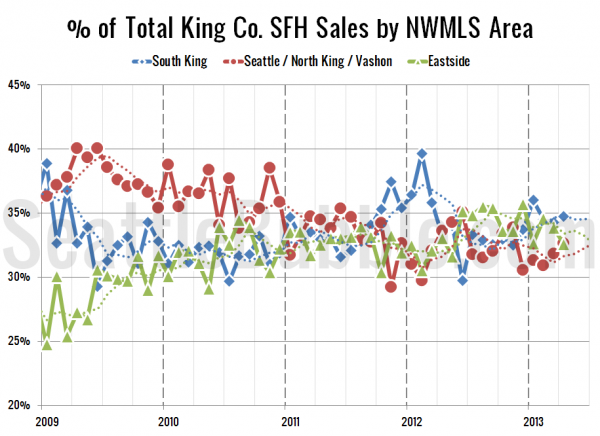

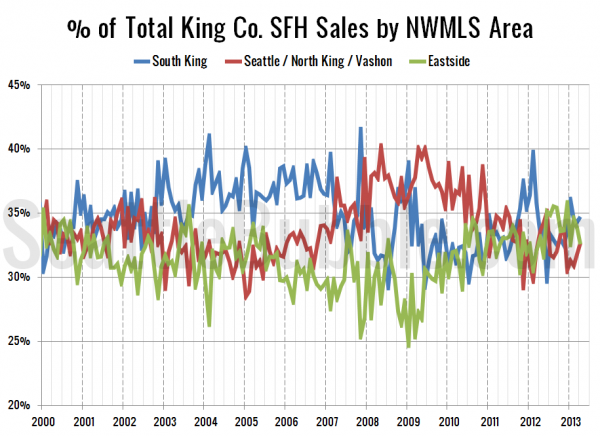

Next up, the percentage of each month’s closed sales that took place in each of the three regions. The dotted line is a four-month rolling average.

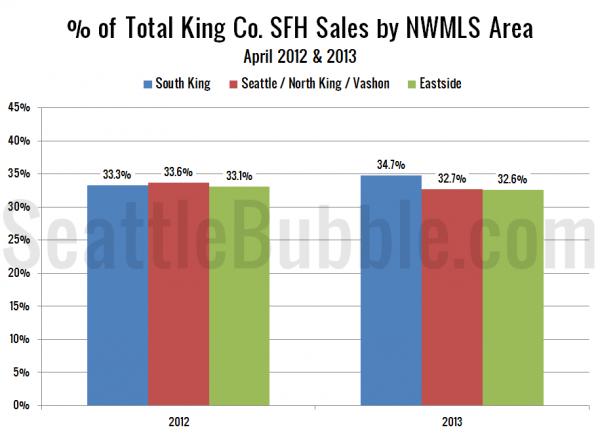

Month over month the low end regions accounted for a slightly larger share of sales. The high end lost share again while the mid-tier gained. As of April 2013, 34.7% of sales were in the low end regions, 32.7% in the mid range, and 32.6% in the high end. A year ago the low end regions had less of the share and the high end more: In April 2012 the low end made up 33.3% of the sales, the mid range was 33.6%, and the high end was 33.1%.

Here’s that information in a visual format:

Finally, here’s an updated look at the percentage of sales data all the way back through 2000:

As the low end gains share we’re heading toward a market that looks similar to what we experienced during the bubble, when the low end regions consistently made up 35% to 40% of the sales. So far things are not that extreme yet though.