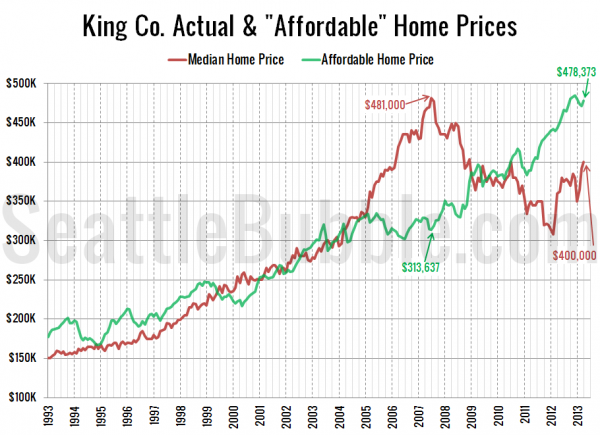

As promised in yesterday’s affordability post, here’s an updated look at the “affordable home” price chart.

In this graph I flip the variables in the affordability index calculation around to other sides of the equation to calculate what price home the a family earning the median household income could afford to buy at today’s mortgage rates if they put 20% down and spent 30% of their monthly income.

A slight increase in interest rates from 3.35% in December to 3.57% in March caused the “affordable” home price to decrease slightly. Rates dipped a bit in April to 3.45%, and the “affordable” home in King County now sits at $478,343, with a monthly payment of $1,707.

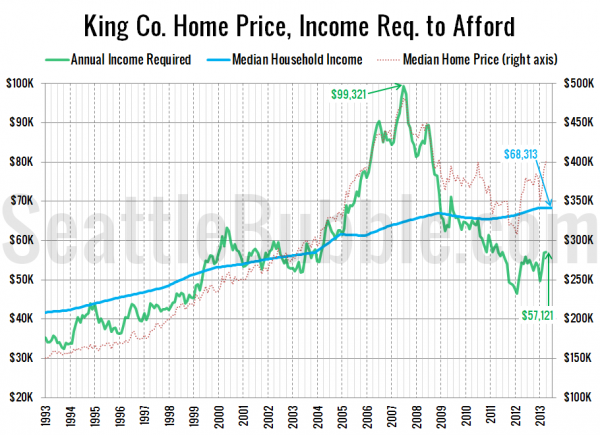

Here’s the alternate view on this data, where I flip the numbers around to calculate the household income required to make the median-priced home affordable at today’s mortgage rates, and compare that to actual median household incomes.

As of April, a household would need to earn $57,121 a year to be able to afford the median-priced $400,000 home in King County (up from $49,732 in January). Meanwhile, the actual median household income is around $68,000.

If interest rates were 6% (around the pre-bust level), the “affordable” home price would drop down to $356,054—11% below the current median price of $400,000, and the income necessary to buy a median-priced home would be $76,742—12% above the current median income. In other words, low rates are basically the only thing keeping prices high right now.