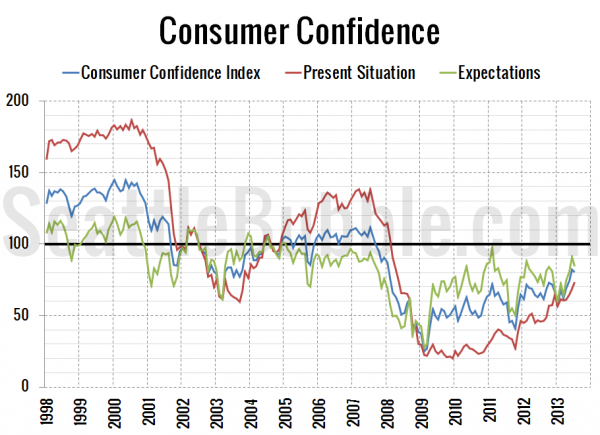

It’s time for another check in on Consumer Confidence. Here’s the data as of July:

At 73.6, the Present Situation Index increased 7% between June and July and has gained 264% from its December 2009 low point. The Present Situation Index now sits at its highest level since May 2008. The Expectations Index fell slightly in July, losing 7% from its June level.

Still no apparent detrimental effect on consumer confidence from the big surge in interest rates that we had in June. Despite interest rates rising from 3.4% in late May to 4.4% in late July, the Present Situation Index has gained 14% over the same period.

Click below for the interactive chart (only works in Google Chrome).

You can use the sliders under the interactive chart below to zoom in on the data for a specific period.