It’s time for us to check up on stats outside of the King/Snohomish core with our “Around the Sound” statistics for Pierce, Kitsap, Thurston, Island, Skagit, and Whatcom counties.

If there is certain data you would like to see or ways you would like to see the data presented differently, drop a comment below and let me know.

This month’s story in a nutshell: Not much change from recent months. Prices keep edging up, listings are slowly increasing, and sales are softening, but it’s still a strong seller’s market.

First up, a summary table:

| July 2014 | King | Snohomish | Pierce | Kitsap | Thurston | Island | Skagit | Whatcom |

|---|---|---|---|---|---|---|---|---|

| Median Price | $468,000 | $335,000 | $234,700 | $255,050 | $235,000 | $272,000 | $225,000 | $278,750 |

| Price YOY | 7.8% | 10.2% | 3.7% | 6.5% | 2.2% | 8.8% | -4.3% | 7.2% |

| Active Listings | 4,862 | 2,614 | 3,945 | 1,433 | 1,393 | 799 | 817 | 1,444 |

| Listings YOY | 6.6% | 34.1% | 21.0% | -0.4% | 14.1% | -8.7% | -0.7% | 4.3% |

| Closed Sales | 2,666 | 971 | 1,128 | 358 | 354 | 141 | 147 | 262 |

| Sales YOY | 0.7% | 0.7% | 0.9% | 1.1% | 7.3% | -4.1% | -9.8% | -7.1% |

| Months of Supply | 1.8 | 2.7 | 3.5 | 4.0 | 3.9 | 5.7 | 5.6 | 5.5 |

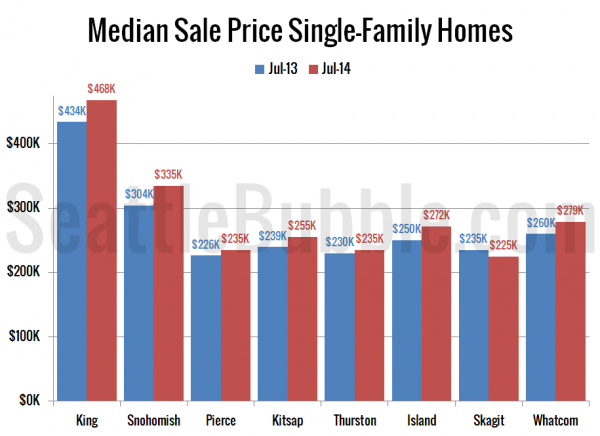

Next let’s take a look at median prices in July compared to a year earlier. Prices were up from a year ago everywhere but Skagit County, which was down 4 percent. Gains ranged from as low as 2 percent in Thurston to as high as 10 percent in Snohomish.

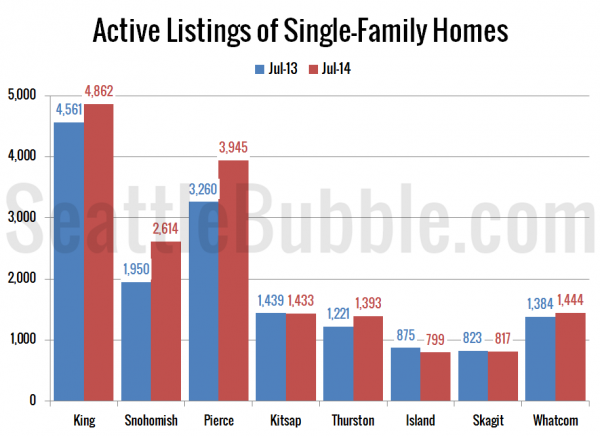

The number of listings grew year-over-year in the close-in counties and Whatcom, but fell in Kitsap, Island, and Skagit counties. The biggest gainer by far was once again Snohomish County at +34 percent. Pierce and Thurston both also saw double-digit gains in inventory again.

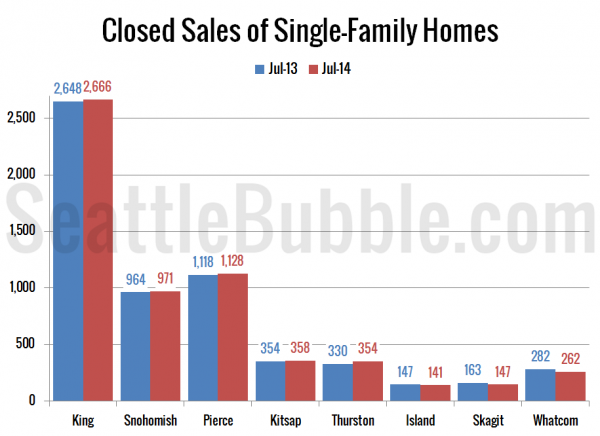

Closed sales fell in July edged up just barely compared to a year earlier in the close-in counties and Kitsap. Thurston saw the biggest sales gain, up 7 percent from last year. Island, Skagit, and Whatcom all saw sales drop from last year’s levels.

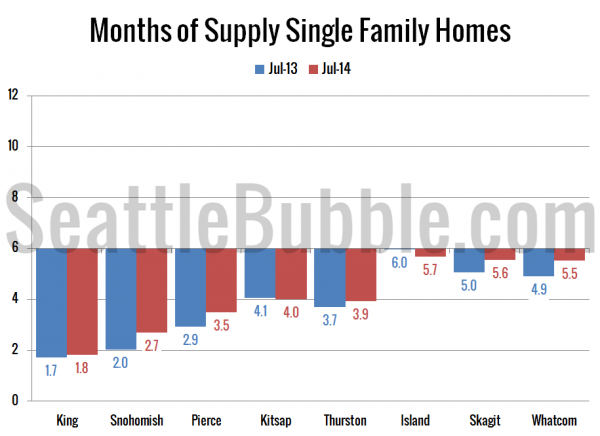

Here’s a chart showing months of supply this July and last July. The market was more balanced than a year ago everywhere but Kitsap and Island, but every county is still in seller’s market territory.

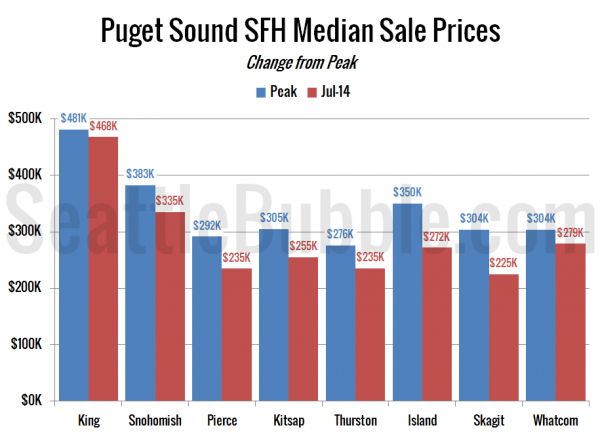

To close things out, here’s a chart comparing July’s median price to the peak price in each county. Everybody is still down from the peak, with drops ranging between just 3 percent in King County to 26 percent in Skagit County.

Unless some catalyst triggers a sudden change in the market, it still looks like it will be quite a while before we get back to anything resembling a balanced market.