I’ve pointed out for years that geographic shifts can and do affect the median price, so it was nice to see none other than Lennox Scott (CEO of John L. Scott) joining the chorus in a recent Seattle Time’s piece.

Lennox Scott, CEO of John L. Scott Real Estate, said the lower price in July also could be due to the mix of homes that sold.

Of course, I pointed out that the geographic mix was likely the reason the county-wide median moved up so much between May and June, while Lennox only feels the need to mention the mix when the median moves down, but whatever. Let’s have a look at this month’s numbers to see how the mix shifted again in July.

In order to explore this concept, we break King County down into three regions, based on the NWMLS-defined “areas”:

- low end: South County (areas 100-130 & 300-360)

- mid range: Seattle / North County (areas 140, 380-390, & 700-800)

- high end: Eastside (areas 500-600)

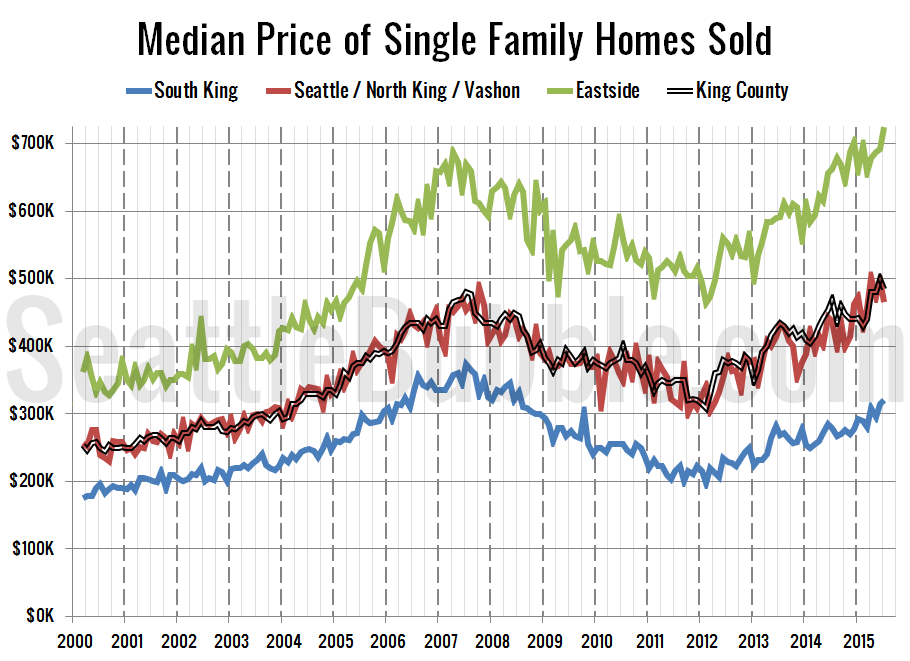

Here’s where each region’s median prices came in as of May data:

- low end: $280,000-$366,325

- mid range: $372,000-$810,000

- high end: $536,500-$1,537,500

First up, let’s have a look at each region’s (approximate) median price (actually the median of the medians for each area within the region).

The low and high tiers saw month-over-month gains in their respective median-median price, while the middle tier fell slightly. The high tier shot up over $30,000 in July to a new all-time high of $723,988. The low tier hit its highest point in 84 months, but still fell short of its August 2007 high. Month-over-month, the median price in the low tier rose 1.9 percent, the middle tier decreased 6.5 percent, and the high tier gained 4.5 percent.

Twenty-five of the twenty-nine NWMLS regions in King County with single-family home sales in July had a higher median price than a year ago, while eleven had a month-over-month increase in the median price.

Here’s how the median prices changed year-over-year. Low tier: up 3.6 percent, middle tier: up 6.3 percent, high tier: up 9.2 percent.

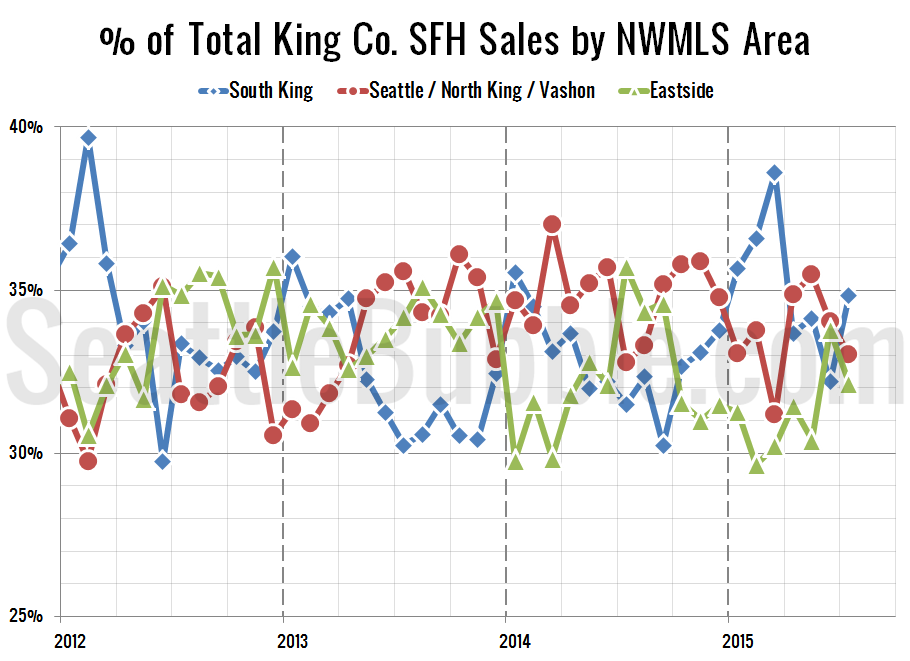

Next up, the percentage of each month’s closed sales that took place in each of the three regions.

Sales in the low tier neighborhoods rose again between June and July, but sales in the middle and high tier neighborhoods fell. The result was a shift back away from expensive Eastside and Seattle sales toward the cheaper South King County region. Month-over-month sales were up 8.0 percent in the low tier, down 3.0 percent in the middle tier, and down 5.0 percent in the high tier.

Year-over-year sales were mixed across the three tiers. Compared to a year ago, sales increased 20.2 percent in the low tier, rose 9.6 percent in the middle tier, and fell 2.1 percent in the high tier.

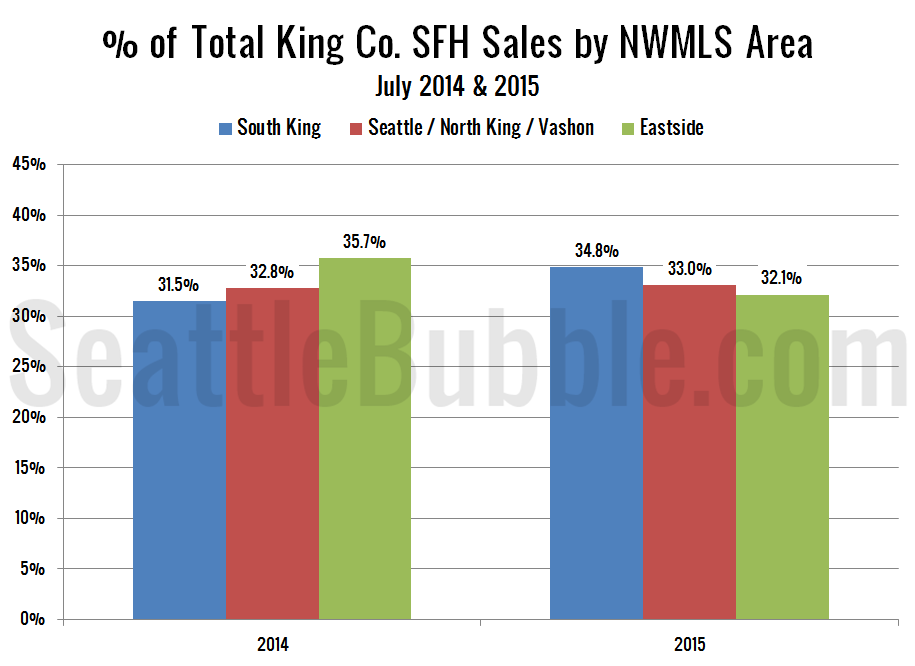

As of July 2015, 34.8 percent of sales were in the low end regions (up from 31.5 percent a year ago), 33.0 percent in the mid range (up just slightly from 32.8 percent a year ago), and 32.1 percent in the high end (down from 35.7 percent a year ago).

Here’s that information in a visual format:

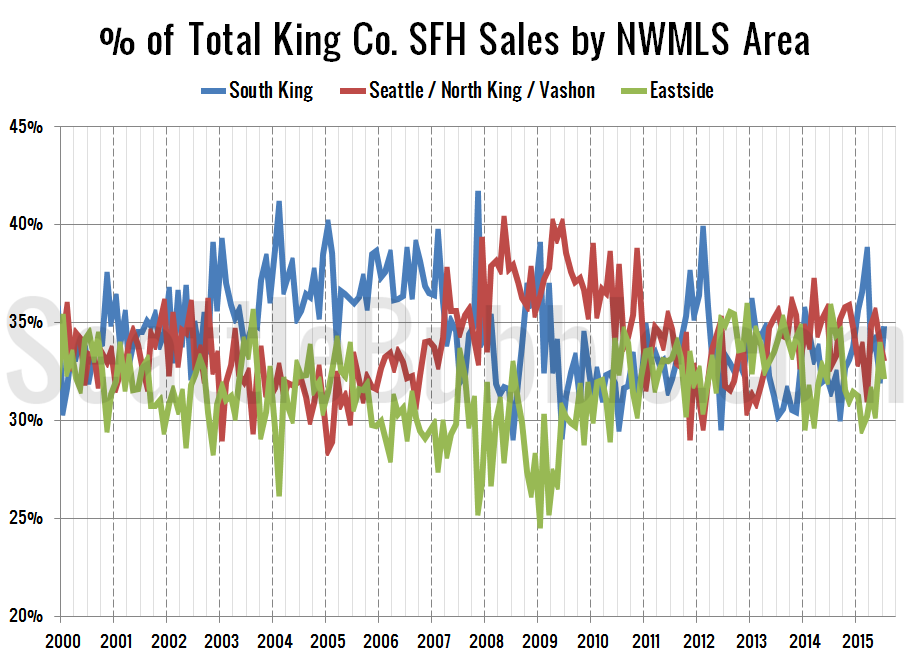

Finally, here’s an updated look at the percentage of sales data all the way back through 2000:

Price-wise, things seem to have cooled down slightly in July, with fewer than half of the NWMLS-defined neighborhoods seeing a month-over-month increase in their respective median price. Sales in the more expensive regions also slowed down, but the increase in cheap regions seems to indicate that demand isn’t starting to dry up just yet. It will be interesting to see if any of these softening signs continue in the next few months.