Get unlimited access to the full spreadsheets used to make the charts in this and other posts, and support the ongoing work of this site by becoming a member of Seattle Bubble.

It’s been quite a while since we took a look at the in-county breakdown data from the NWMLS to see how the sales mix shifted around the county.

In order to explore this concept, we break King County down into three regions, based on the NWMLS-defined “areas”:

- low end: South County (areas 100-130 & 300-360)

- mid range: Seattle / North County (areas 140, 380-390, & 700-800)

- high end: Eastside (areas 500-600)

Here’s where each region’s median prices came in as of January data:

- low end: $310,000-$429,500

- mid range: $469,250-$800,000

- high end: $649,995-$1,508,750

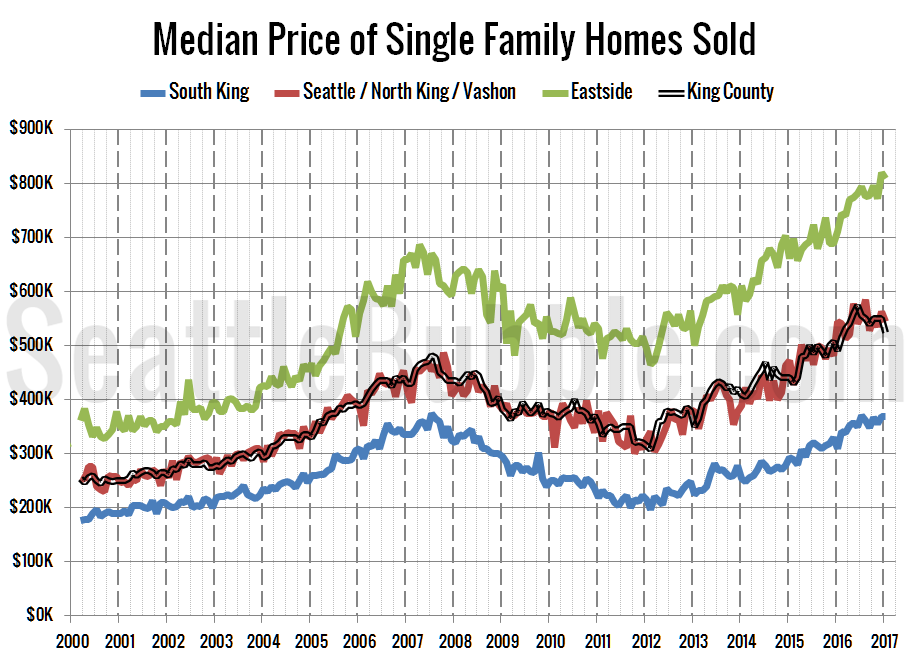

First up, let’s have a look at each region’s (approximate) median price (actually the median of the medians for each area within the region).

Only the low tier saw a month-over-month gain in its respective median-median price, while the middle and high tiers both fell slightly. All three tiers are currently at a level lower than their respective all-time highs. Month-over-month, the median price in the low tier rose 0.3 percent, the middle tier decreased 3.3 percent, and the high tier lost 1.2 percent.

Twenty-five of the twenty-nine NWMLS regions in King County with single-family home sales in January had a higher median price than a year ago, while Fifteen had a month-over-month increase in the median price.

Here’s how the median prices changed year-over-year. Low tier: up 19.2 percent, middle tier: up less than 0.1 percent, high tier: up 13.8 percent.

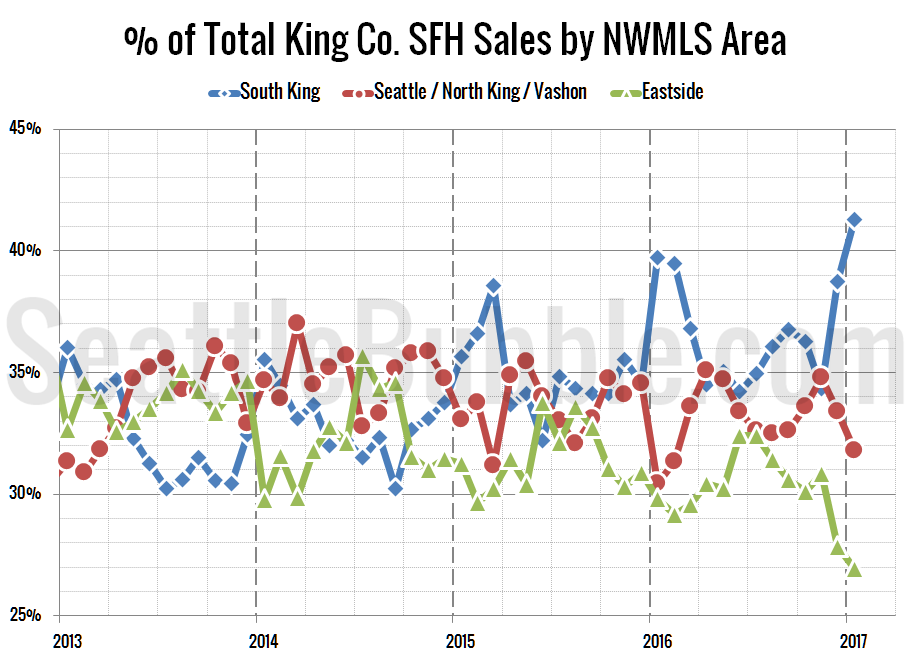

Next up, the percentage of each month’s closed sales that took place in each of the three regions.

Sales in all three tiers fell between December and January, with the middle and high tiers seeing the biggest dips. Month-over-month sales were down 21.8 percent in the low tier, down 30.1 percent in the middle tier, and down 29.0 percent in the high tier.

Meanwhile, year-over-year sales were up considerably in all three tiers. Compared to a year ago, sales increased 25.1 percent in the low tier, rose 25.8 percent in the middle tier, and gained 8.7 percent in the high tier.

The interesting thing is the strong shift in the sales mix in recent mix away from the high tier and into the low tier.

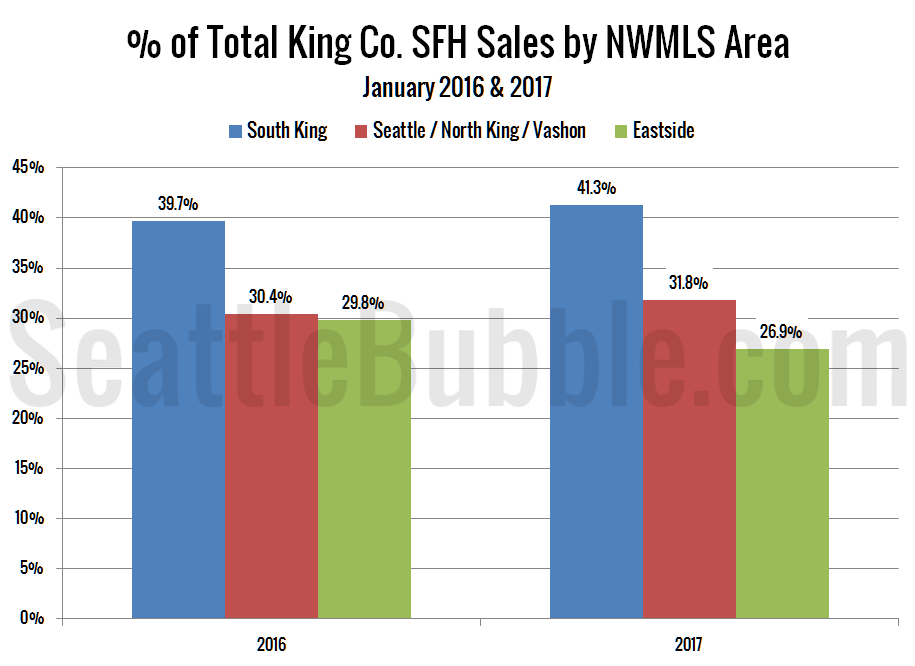

As of January 2017, 41.3 percent of sales were in the low end regions (up from 39.7 percent a year ago), 31.8 percent in the mid range (up from 30.4 percent a year ago), and 26.9 percent in the high end (down from 29.8 percent a year ago).

Here’s that information in a visual format:

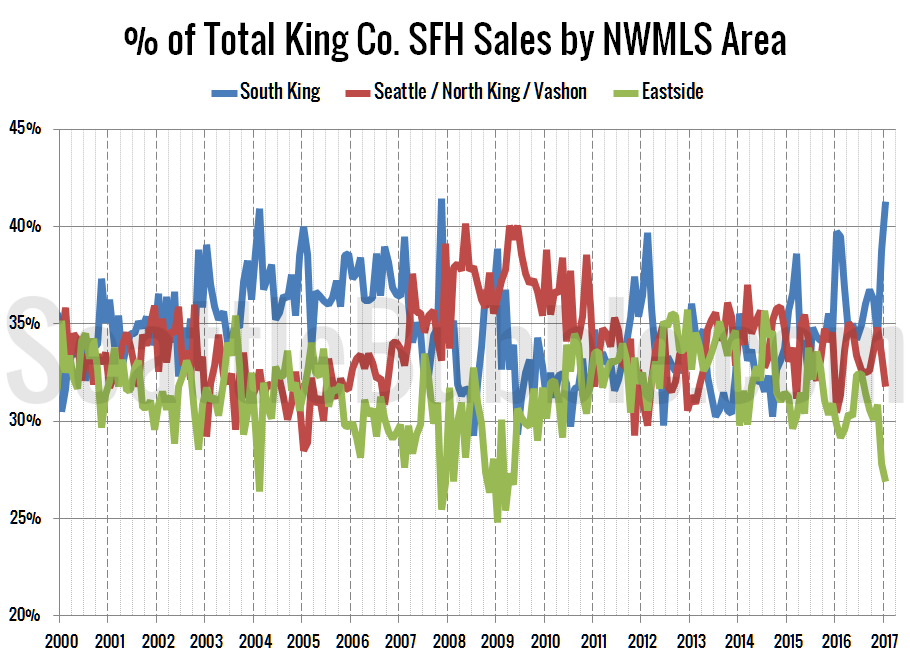

Finally, here’s an updated look at the percentage of sales data all the way back through 2000:

With sales shifting strongly into the lower-priced regions, it’s no surprise that the county-wide median price fell slightly. The last time this large a share of sales were in the low-tier parts of the county was in November 2007, just a few months after home prices peaked.