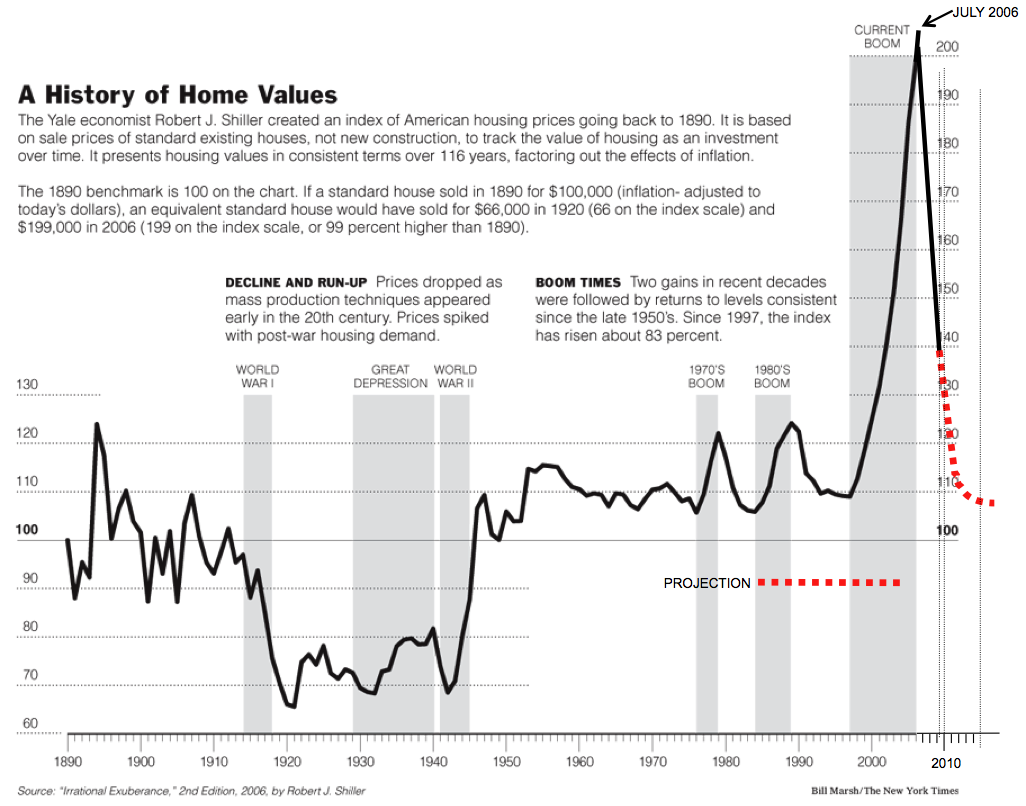

For instance, when we look at the Case Shiller data, we see a peak in housing prices in 1979, 1989, and 2006. But the peak in home prices when denominated in gold is much earlier. Note the peaks are in 1975, 1986, and 2001 My hypothesis is that 'smart money' liquidated their real estate prior to the real estate peaks, and then put the assets into something safe, which was gold. Therefore, a peak in asset prices when denominated in gold may predict a peak when denominated in dollars.