Welcome to September! Another new month, and it is time yet again to check in on our monthly stats preview for King and Snohomish counties. Most of the charts below are based on broad county-wide data that is available through a simple search of King County and Snohomish County public records. If you have additional stats you’d like to see in the preview, drop a line in the comments and I’ll see what I can do.

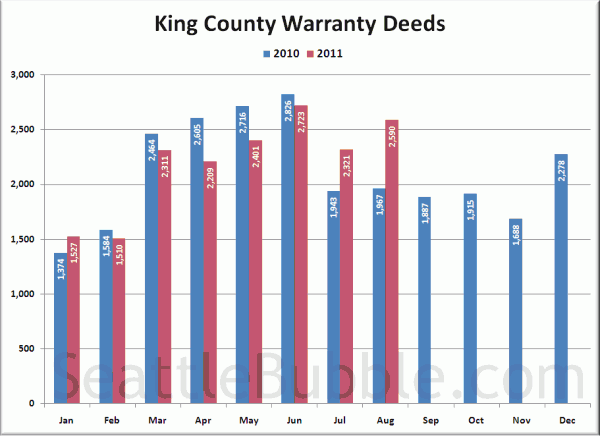

First up, total home sales as measured by the number of “Warranty Deeds” filed with King County:

Now that’s interesting. Sales as measured by Warranty Deeds bumped up over 10% from July. Ordinarily sales tend to decline through the end of the year, so this increase is rather unusual. It will be interesting to see if the official NWMLS stats show the same bump.

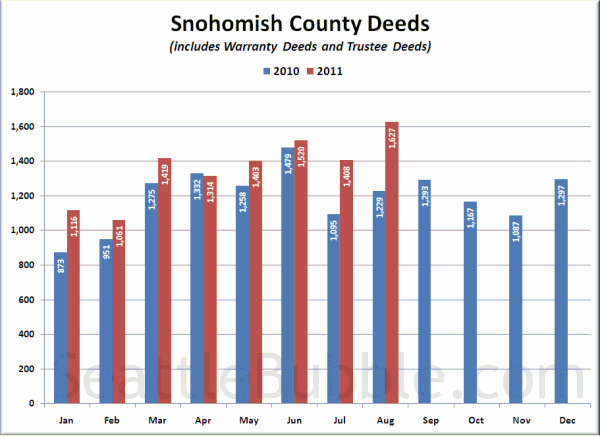

Here’s a look at Snohomish County Deeds, but keep in mind that Snohomish County files Warranty Deeds (regular sales) and Trustee Deeds (bank foreclosure repossessions) together under the category of “Deeds (except QCDS),” so this chart is not as good a measure of plain vanilla sales as the Warranty Deed only data we have in King County.

Same thing in Snohomish, but even more pronounced. 15% increase over July.

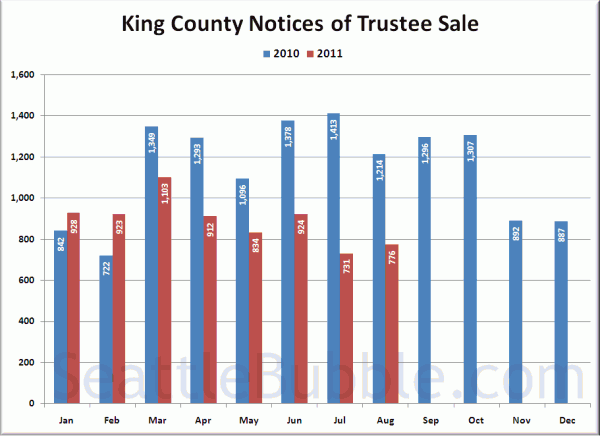

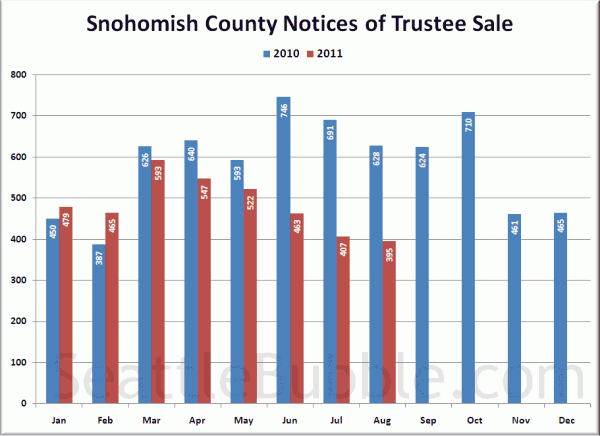

Next, here’s Notices of Trustee Sale, which are an indication of the number of homes currently in the foreclosure process:

Basically flat month to month. Up a little in King, down a little in Snohomish, but more or less within the usual monthly noise level.

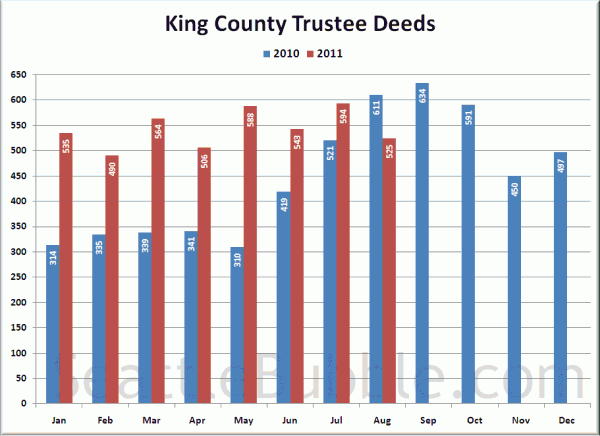

Here’s another measure of foreclosures for King County, looking at Trustee Deeds, which is the type of document filed with the county when the bank actually repossesses a house through the trustee auction process. Note that there are other ways for the bank to repossess a house that result in different documents being filed, such as when a borrower “turns in the keys” and files a “Deed in Lieu of Foreclosure.”

Falling to the lowest level since April, Trustee Deeds marked their first year-over-year drop since I began tracking this stat in 2007.

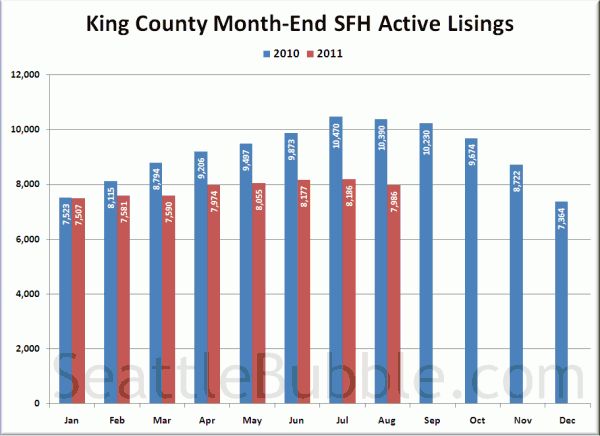

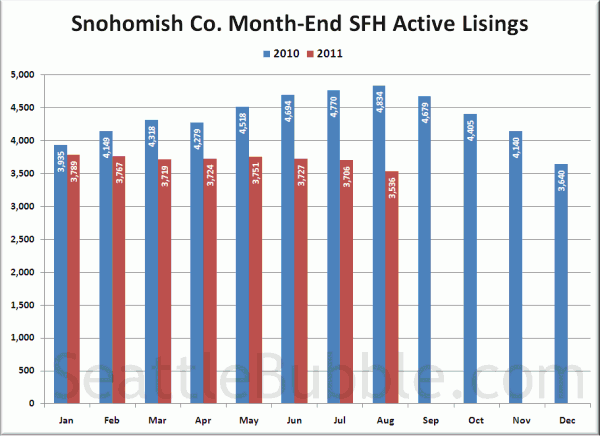

Lastly, here’s an update of the inventory charts, updated with the inventory data from the NWMLS.

As expected, inventory is on its way down into the winter hibernation. Prepare for the slow season.

Stay tuned later this month a for more detailed look at each of these metrics as the “official” data is released from various sources.