It’s time for us to check up on stats outside of the King/Snohomish core with our “Around the Sound” statistics for Pierce, Kitsap, Thurston, Island, Skagit, and Whatcom counties.

If there is certain data you would like to see or ways you would like to see the data presented differently, drop a comment below and let me know.

This month’s story in a nutshell: More supply, fewer sales, higher prices pretty much across the board.

First up, a summary table:

| May 2014 | King | Snohomish | Pierce | Kitsap | Thurston | Island | Skagit | Whatcom |

|---|---|---|---|---|---|---|---|---|

| Median Price | $442,250 | $325,000 | $235,000 | $230,500 | $229,000 | $247,250 | $233,500 | $272,900 |

| Price YOY | 5.9% | 8.2% | 9.3% | -5.9% | 0.8% | -1.0% | 1.5% | 3.0% |

| Active Listings | 4,158 | 2,206 | 3,428 | 1,238 | 1,274 | 767 | 783 | 1,288 |

| Listings YOY | 10.6% | 43.8% | 23.5% | -7.4% | 18.0% | -4.8% | 5.5% | 4.0% |

| Closed Sales | 2,326 | 858 | 1,086 | 298 | 310 | 120 | 153 | 215 |

| Sales YOY | -7.6% | -11.2% | 3.3% | -8.3% | -4.6% | 9.1% | 11.7% | -11.5% |

| Months of Supply | 1.8 | 2.6 | 3.2 | 4.2 | 4.1 | 6.4 | 5.1 | 6.0 |

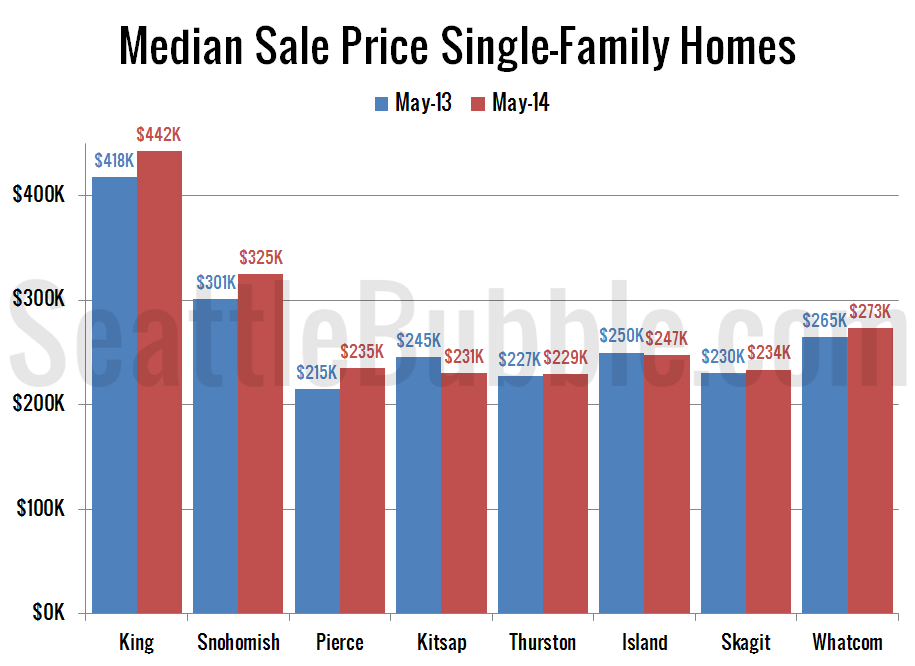

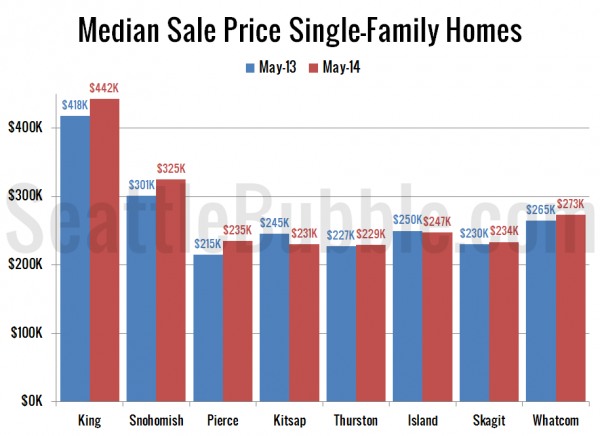

Next let’s take a look at median prices in May compared to a year earlier. Prices were up from a year ago everywhere but Kitsap (down 6 percent) and Island (down 1 percent). Gains in the other counties ranged from as low as 1 percent in Thurston to as high as 9 percent in Pierce.

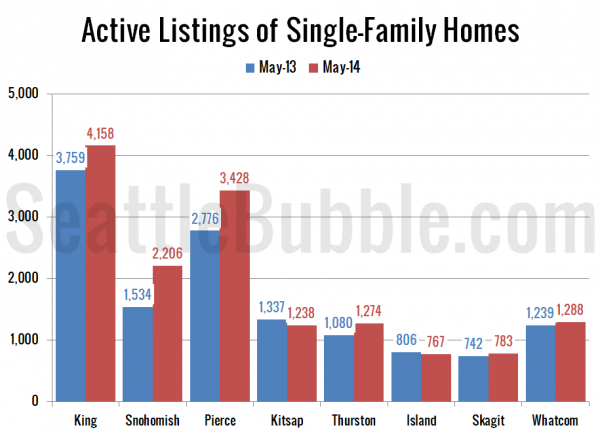

Listings are still increasing year-over-year in King, Snohomish, Pierce, and Thurston. This month Whatcom and Skagit also saw more homes on the market than a year ago. Interestingly, the only two counties with declining inventory were Kitsap and Island—the same two counties with decreasing prices. This is opposite of what you’d expect, where more supply typically puts downward pressure on prices.

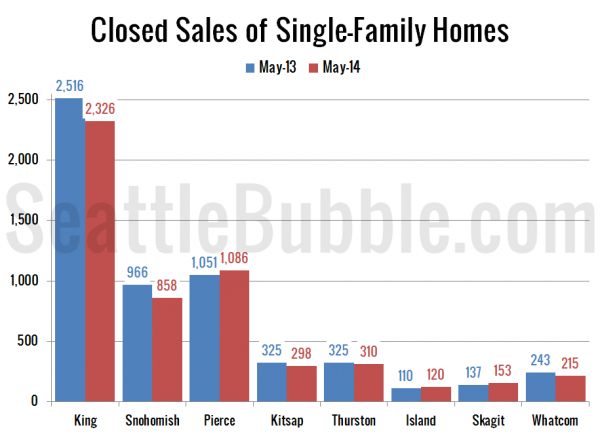

Closed sales fell in May in King, Snohomish, Kitsap, Thurston, and Whatcom, but were up from a year ago in Pierce, Island, and Skagit.

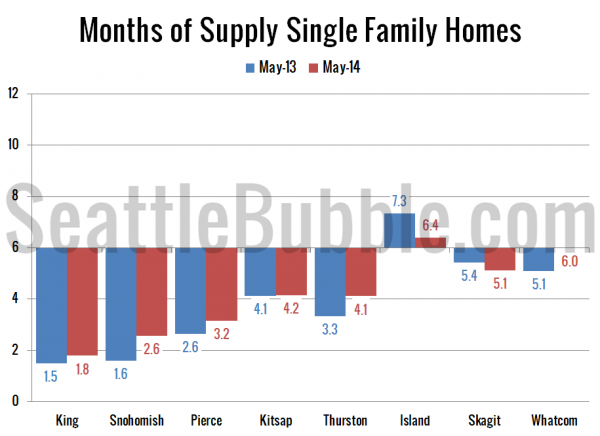

Here’s a chart showing months of supply this May and last May. The market was more balanced than a year ago in every county but Skagit, where months of supply dropped from 5.4 to 5.1.

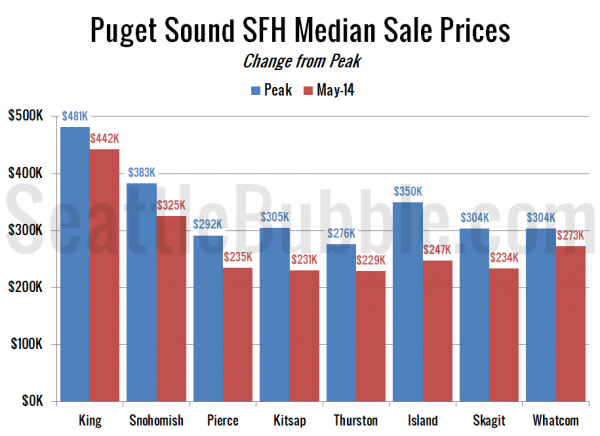

To close things out, here’s a chart comparing May’s median price to the peak price in each county. Everybody is still down between 8 percent (King) and 29 percent (Island).

Most counties are still inching toward a more balanced market, and while prices are still increasing, the size of those gains seems to be shrinking.