Get access to the full spreadsheets used to make the charts in this and other posts, as well as a variety of additional insider benefits by becoming a member of Seattle Bubble.

The NWMLS published their May stats today, so let’s take a look at how the month shook out for the housing market. The King County median price of single-family homes was down year-over-year in May, the third month in a row of declines. Inventory was up from a year ago again, but the as we mentioned in the preview post earlier this week, the rate of increase is rapidly declining from the all-time high set in December. Pending and closed sales are increasing, but only modestly.

The NWMLS hasn’t published their press release yet, so let’s get straight into the numbers.

NWMLS monthly reports include an undisclosed and varying number of

sales from previous months in their pending and closed sales statistics.

Here’s your King County SFH summary, with the arrows to show whether the year-over-year direction of each indicator is favorable or unfavorable news for buyers and sellers (green = favorable, red = unfavorable):

| May 2019 | Number | MOM | YOY | Buyers | Sellers |

|---|---|---|---|---|---|

| Active Listings | 4,511 | +26.2% | +54.9% |  |

|

| Closed Sales | 2,642 | +23.1% | +6.8% |  |

|

| SAAS (?) | 1.57 | +5.0% | -1.1% |  |

|

| Pending Sales | 3,388 | +8.3% | +2.3% |  |

|

| Months of Supply | 1.71 | +2.5% | +45.1% |  |

|

| Median Price* | $700,000 | +1.4% | -3.6% |  |

|

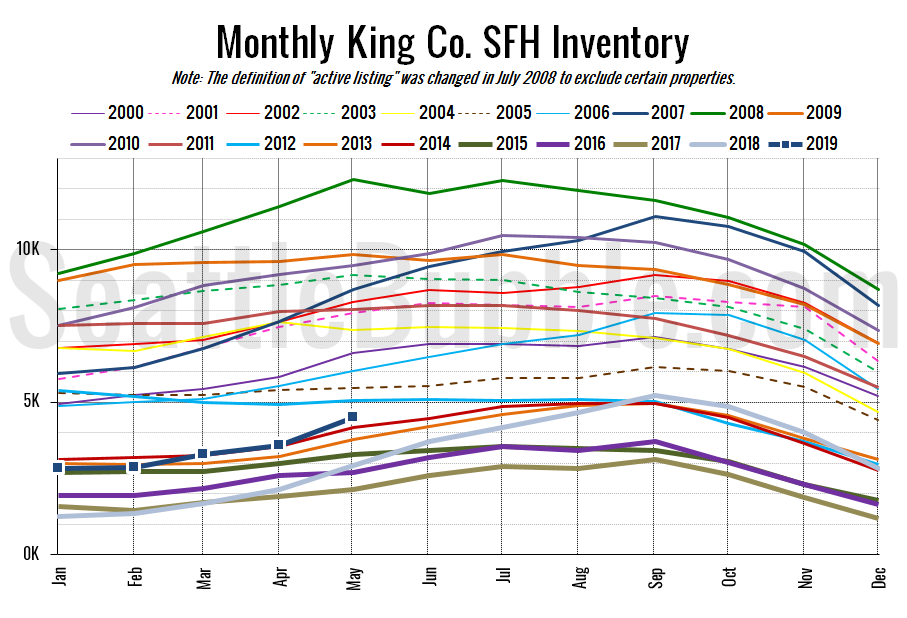

Here’s the graph of inventory with each year overlaid on the same chart.

Inventory was up 26 percent from April to May, which is the second-largest May increase on record. May of last year saw a 37 percent month-over-month gain. This month’s inventory level is the highest we’ve seen at the end of May since 2012. Overall, the supply situation is still a good sign for buyers.

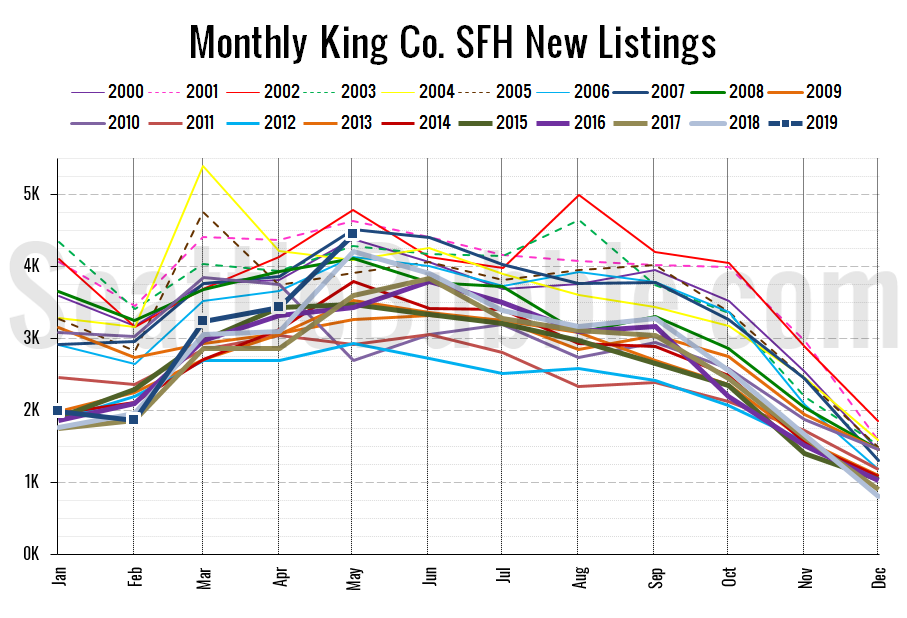

Here’s the chart of new listings:

New listings were up 29 percent from April to May, and were up six percent from a year ago. It’s the highest number of new listings in the month of May since 2012.

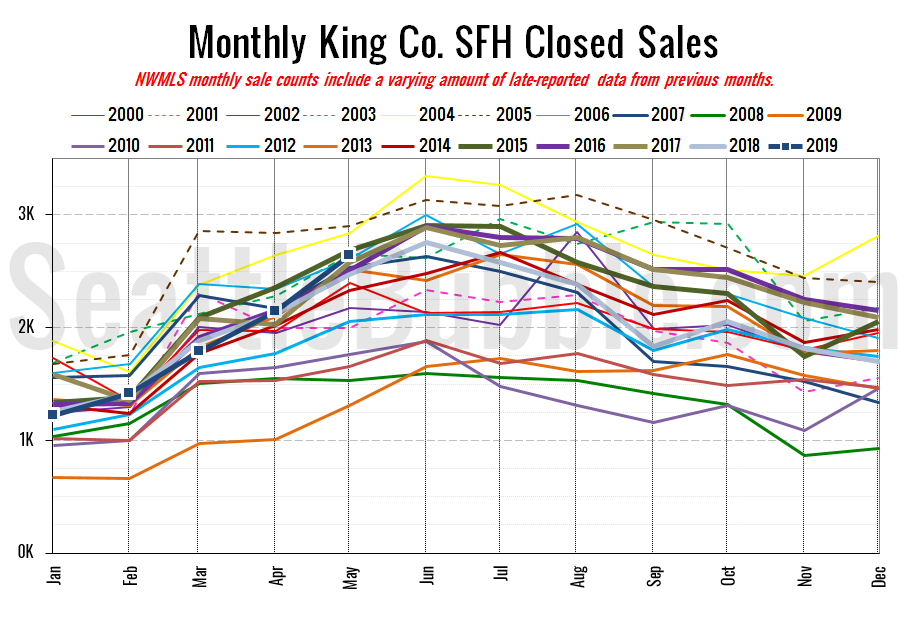

Here’s your closed sales yearly comparison chart:

Closed sales rose 23 percent between April and May, and were up 7 percent from last year. Closed sales have been in a fairly tight range between 2,300 and 2,700 in May every year since 2013, and this year is no exception.

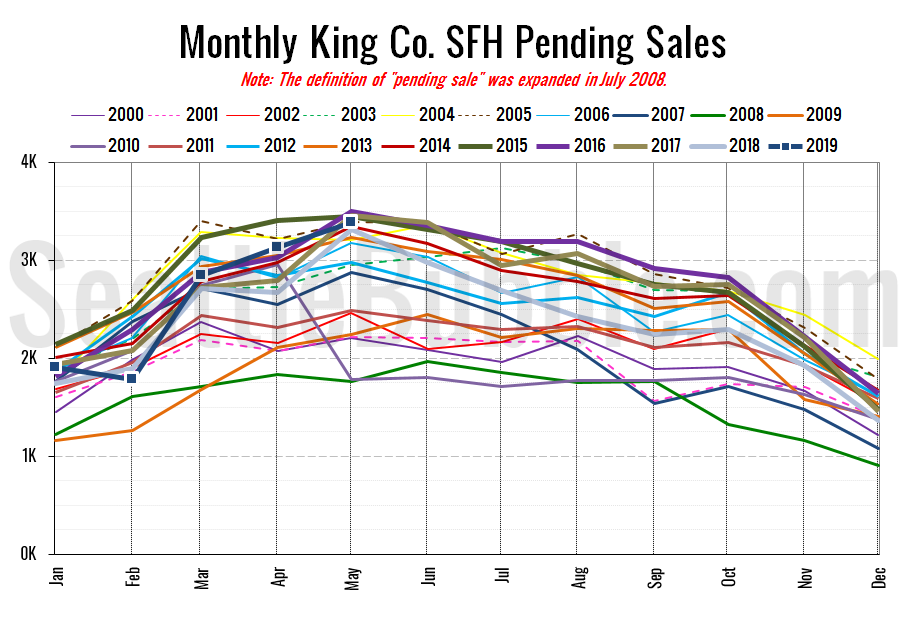

Pending sales rose 8 percent month-over-month and were basically flat year-over-year. At the same time last year, pending sales were up 24 percent month-over-month.

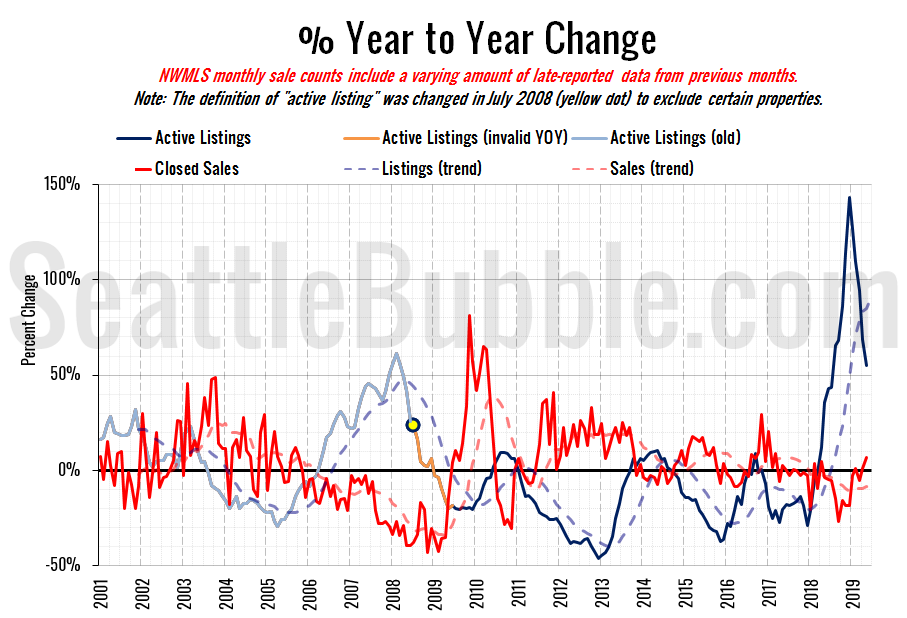

Here’s the supply/demand YOY graph. “Demand” in this chart is represented by closed sales, which have had a consistent definition throughout the decade (unlike pending sales from NWMLS).

We knew the huge gains late last year wouldn’t last. Although the rate of increase is falling off fast, we’re still in basically record territory. Very few times have seen year-over-year gains in inventory that were this large.

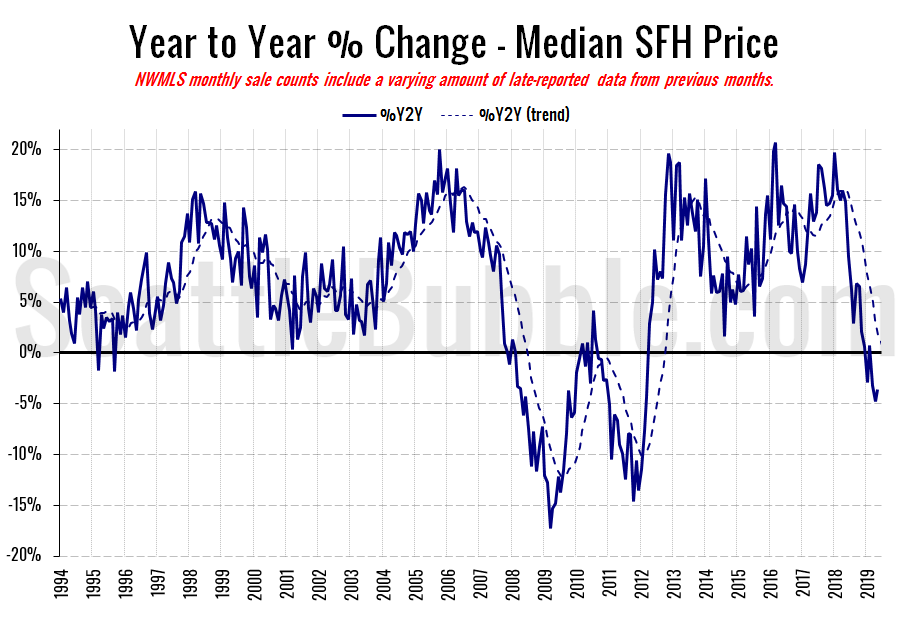

Here’s the median home price YOY change graph:

That’s three months in a row of falling prices compared to a year ago. Definitely interesting. Perhaps prices around here have finally hit a saturation point?

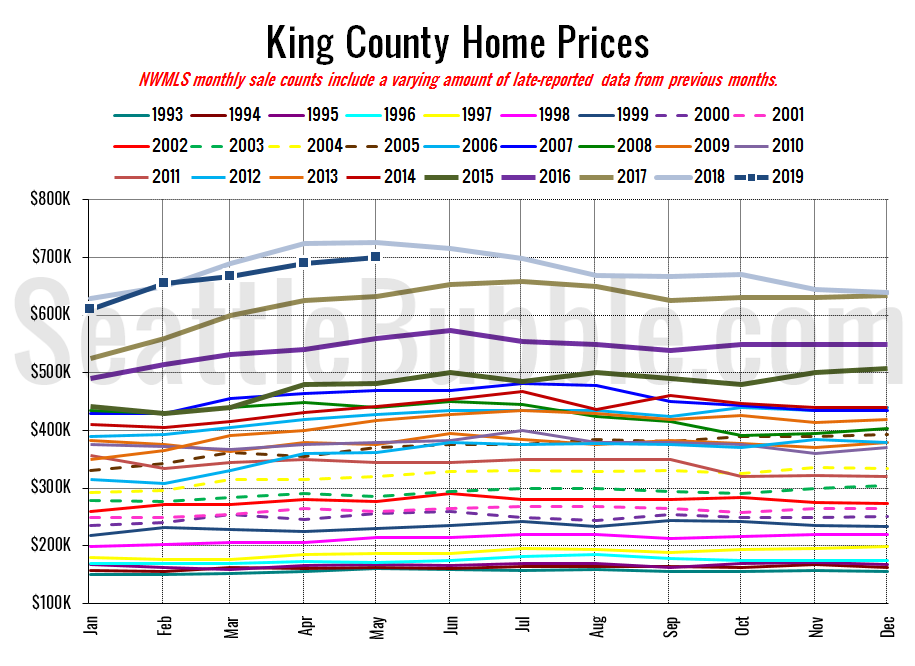

And lastly, here is the chart comparing King County SFH prices each month for every year back to 1994 (not adjusted for inflation).

May 2019: $700,000

May 2018: $726,275

July 2007: $481,000 (previous cycle high)

So far there’s no story posted yet on the May data from the Seattle Times. I’ll update this post when their story goes up.

Side-note: In case you missed it, last month the Seattle Times real estate reporter Mike Rosenberg was suspended from his job for inappropriate behavior. His harassment detailed in that story is very disappointing and frankly, gross. Men should treat all women with respect, all the time. It is really not that hard. It’s especially disappointing to me because I have highly respected his work at the Times for years.

[Update]

Here’s Paul Roberts’ story for the Seattle Times: Seattle housing market stays cool, while Tacoma and suburbs keep up the heat