Home prices in Seattle continued their slide in November, according to the latest data from the Case-Shiller Home Price Index.

Down 1.43% October to November.

Up 1.77% YOY.

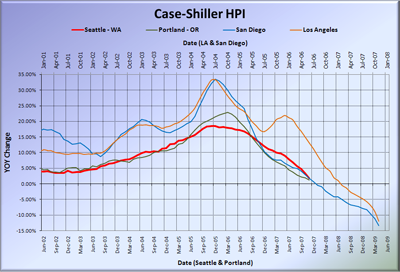

That’s the fourth month-to-month decline in a row, and a year-to-year increase of barely more than half of October’s already paltry 3.30%. Here’s the usual graph, with L.A. & San Diego offset from Seattle & Portland by 17 months. I had to re-align the vertical axis, since San Diego is now seeing nearly -15% year-to-year declines. Ouch.

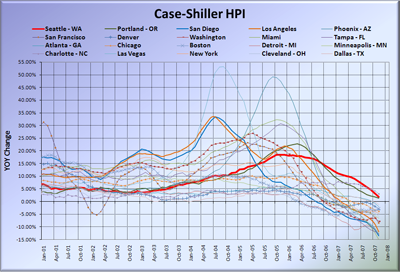

And yet again, here’s all twenty cities tracked by Case-Shiller, with no time-shifting.

Yowzers. It looks like a race to the bottom. But don’t pay attention to all that “doom and gloom” data. Just follow your gut and jump right into an enormous loan on a depreciating asset. You know you want to.

(Home Price Indices, Standard & Poor’s, 01.29.2008)