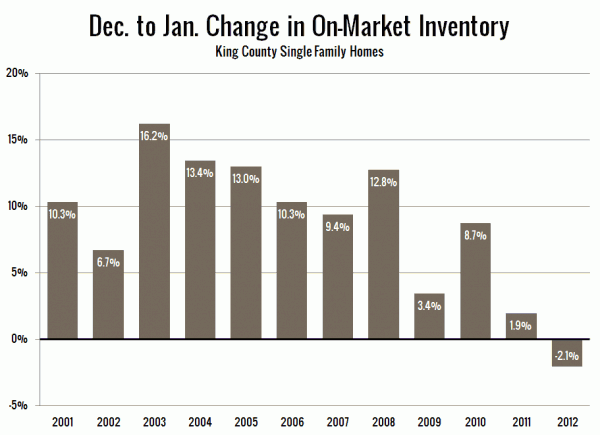

Ordinarily, when the calendar flips over to a new year, it’s like somebody flipped a switch. The direction of on-market inventory literally does a 180 in a single day, from a constant decline through the last quarter to a steady increase leading into spring.

This year… not so much:

Last year was fairly bad (which I pointed out less than two weeks into the year), but at least there was some increase in selection between December and January.

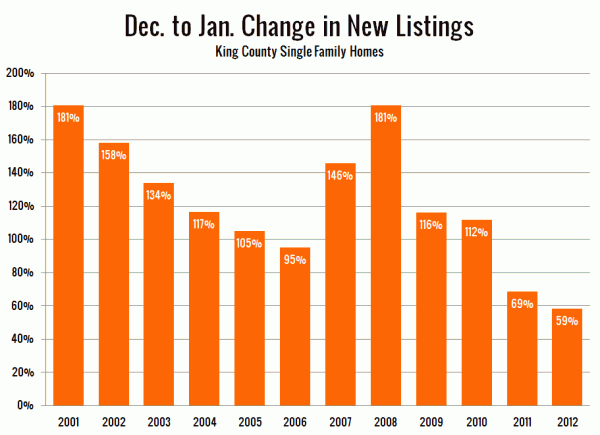

Sales are actually slowly climbing out of the gutter, but listings are falling through the floor. I suspect this will be a frustrating year to be a home buyer.