It’s been quite a while since we’ve had a look at how King County’s sales are shifting between the different regions around the county, and it’s way past time for an update.

The reason this is interesting is the interplay between sales shifts and median price. For example, as more sales occur in lower-priced areas, it can shift the median price down further than the individual areas’ median prices may have moved.

In order to explore this concept, we break King County down into three regions, based on the NWMLS-defined “areas”:

- low end: South County (areas 100-130 & 300-360)

- mid range: Seattle / North County (areas 140, 380-390, & 700-800)

- high end: Eastside (areas 500-600)

Here’s where each region’s median prices came in as of January’s data:

- low end: $155,000—$322,500

- mid range: $222,250—$605,000

- high end: $365,000—$1,190,000

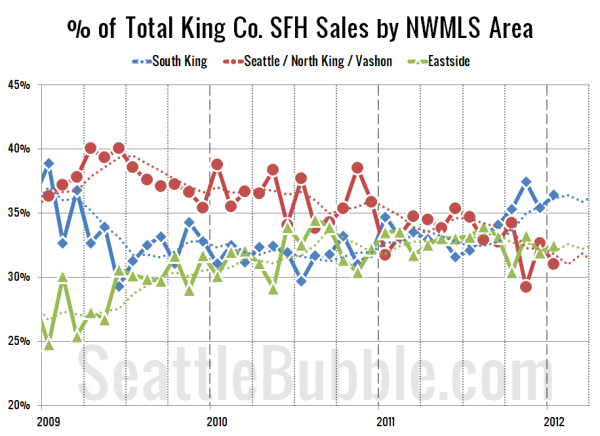

In the following chart I have plotted the percentage of each month’s closed sales that took place in each of the three regions. The dotted line is a four-month rolling average.

Interestingly, sales in the mid range region have been steadily dipping over the last few years, while sales in the high end region have been gaining ground. That is, until October or so, when sales in the low end region started shooting up, taking share away from the mid range and high end. Not coincidentally, that shift coincided with the big drop in the county-wide median in October.

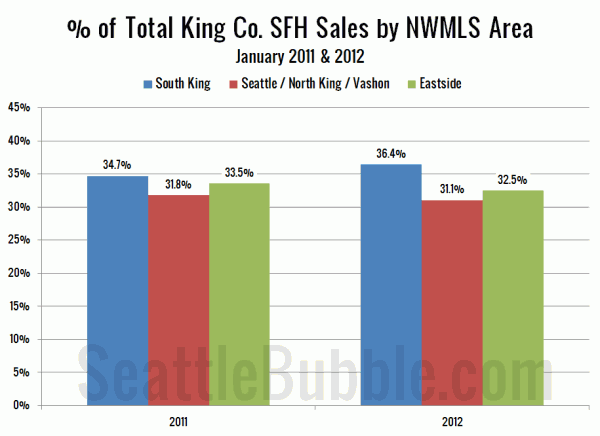

Here’s a look at just January 2011 and January 2012:

Compared to exactly a year ago, South King’s share of the sales grew, taking from both Seattle and the Eastside.

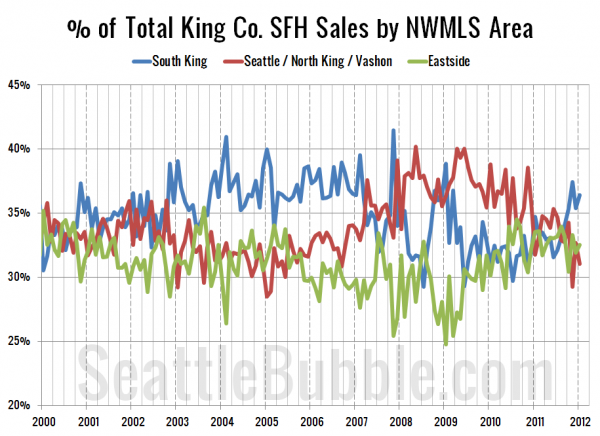

Lastly, here’s an updated look at this same set of data all the way back through 2000:

The move since last October seems to be going back toward a mix more like what we saw during the heyday of the bubble between 2004 and 2006. Hopefully the uptick in action at the low end isn’t a portent to another feeding frenzy.

It will be interesting to see if this pattern continues through 2012. My sense is that the low end is picking up because we’re seeing a bit of an uptick in value-shoppers and investors looking for homes to rent out or flip.