Let’s check in again on the cheapest homes around Seattle proper. Here’s our methodology: I search the listings for the cheapest homes currently on the market, excluding short sales, in the city of Seattle proper. Any properties that are in obvious states of extreme disrepair based on listing photos and descriptions will be excluded. This includes any listing that uses the phrases “fixer,” “rehab loan,” or “value in land.” I post the top (bottom) three, along with some overall stats on the low end of the market.

Please note: These posts should not be construed to be an advertisement or endorsement of any specific home for sale. We are merely taking a brief snapshot of the market at a given time. Also, just because a home makes it onto the “cheapest” list, that does not indicate that it is a good value.

Here are this month’s three cheapest single-family homes in the city limits of Seattle (according to Redfin):

| Address | Price | Beds | Baths | SqFt | Lot Size | Neighborhood | $ / SqFt | Notes |

|---|---|---|---|---|---|---|---|---|

| 3843 17th Ave SW | $89,900 | 1 | 1 | 740 | 2,500 sqft | Delridge | $121 | bank owned |

| 8513 16th Ave SW | $175,000 | 3 | 1 | 880 | 5,120 sqft | Delridge | $199 | flip |

| 751 S Cloverdale St | $175,000 | 2 | 1.75 | 700 | 2,700 sqft | South Park | $216 | – |

Yes, you read that right. The second-cheapest home this month is actually a flip. Sold in April for $142,500, the home has allegedly had “over $80k in upgrades” (according to the listing), and is now back on the market at $175,000. I somehow doubt the flipper will be losing $40,000 at this asking price.

Two of last month’s homes have gone pending, while the third carried over to this month as number three.

Stats snapshot for Seattle Single-Family Homes Under $200,000 (excluding short sales)

Total on market: 15

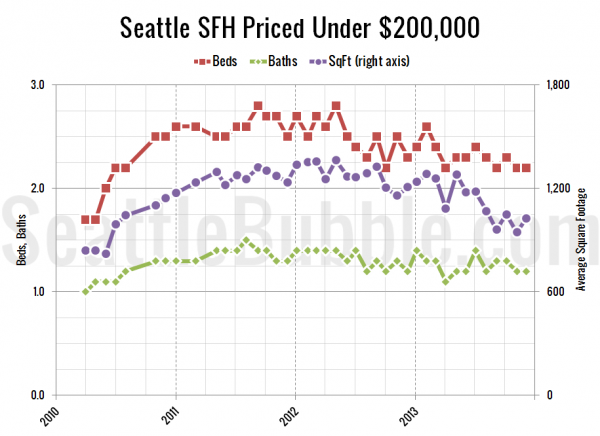

Average number of beds: 2.2

Average number of baths: 1.2

Average square footage: 1,026

Average days on market: 60

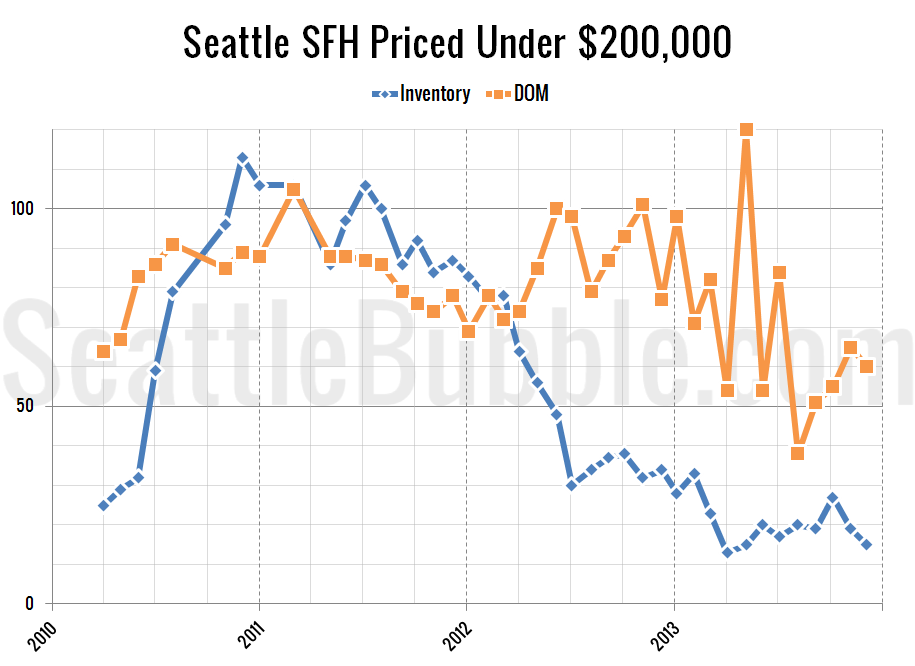

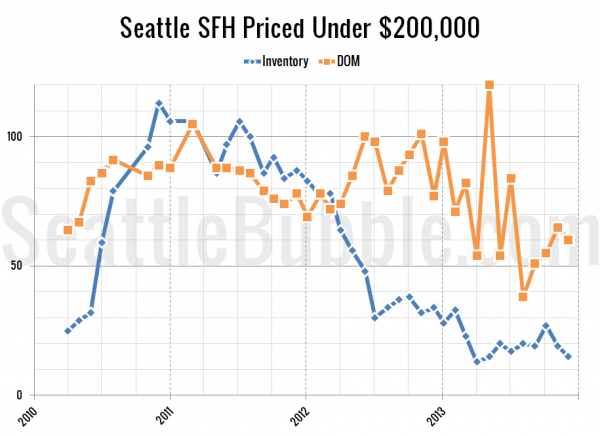

Inventory continued to fall in the month, but it is still above the low point set in April. Meanwhile, the average size moved up slightly.

Here are our usual charts to give you a visual of the trend of these numbers since I adjusted the methodology in April 2010:

Here are cheapest homes in Seattle that actually sold in the last month, regardless of condition (since most off-market homes don’t have much info available on their condition).

| Address | Price | Beds | Baths | SqFt | Lot Size | Neighborhood | $ / SqFt | Sold On |

|---|---|---|---|---|---|---|---|---|

| 8426 10th Ave SW | $115,000 | 4 | 1 | 1090 | 7,620 sqft | Delridge | $106 | 11/05/2013 |

| 8341 39th Ave S | $119,950 | 3 | 1 | 940 | 6,583 sqft | Beacon Hill | $128 | 11/20/2013 |

| 7922 48th Ave S | $130,000 | 3 | 1 | 1,120 | 5,060 sqft | Rainier Valley | $116 | 11/18/2013 |