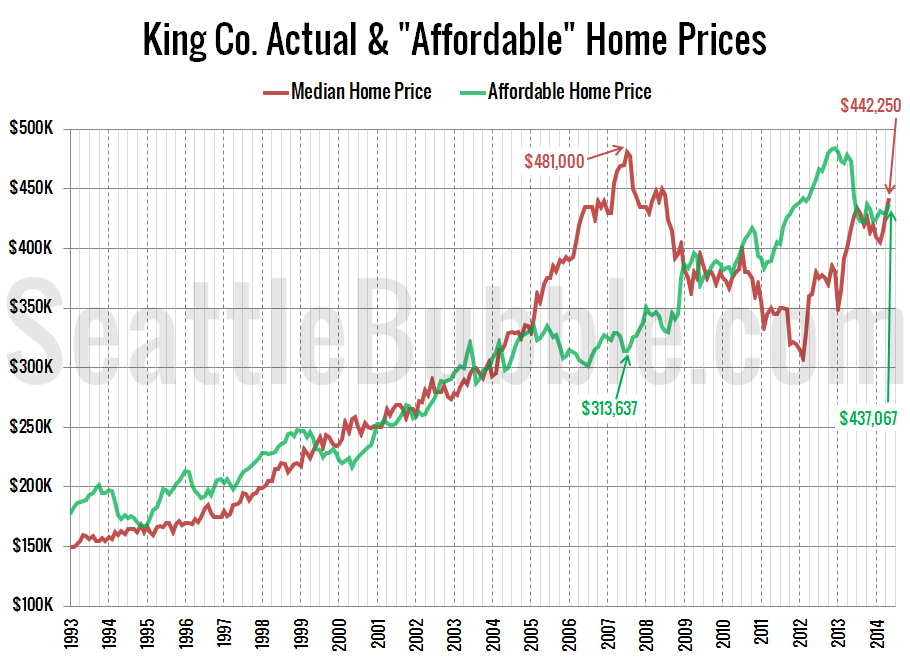

As promised in this morning’s affordability post, here’s an updated look at the “affordable home” price chart.

In this graph I flip the variables in the affordability index calculation around to other sides of the equation to calculate what price home the a family earning the median household income could afford to buy at today’s mortgage rates if they put 20% down and spent 30% of their monthly income.

The “affordable” home price actually rose in May thanks to a dip in rates to their lowest points since October. The “affordable” home in King County now sits at $437,067, with a monthly payment of $1,708.

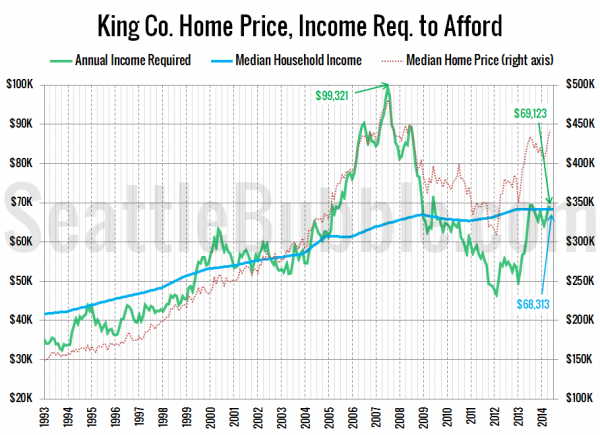

Here’s the alternate view on this data, where I flip the numbers around to calculate the household income required to make the median-priced home affordable at today’s mortgage rates, and compare that to actual median household incomes.

As of May, a household would need to earn $69,123 a year to be able to afford the median-priced $442,250 home in King County. This is up from the low of $46,450 in February 2012, but up month-over-month to the highest point since last August. Meanwhile, the actual median household income is around $68,000.

If interest rates were 6% (around the pre-bust level), the “affordable” home price would drop down to $356,064—19 percent below the current median price of $442,250, and the income necessary to buy a median-priced home would be $84,848—24 percent above the current median income.

Dipping rates helped keep affordability from dropping with the spring boost in home prices. If rates stay low, home prices will probably continue to increase in the near term as the local economy continues to boom, but if rates start to go up, expect that to quickly put the brakes on home price gains.