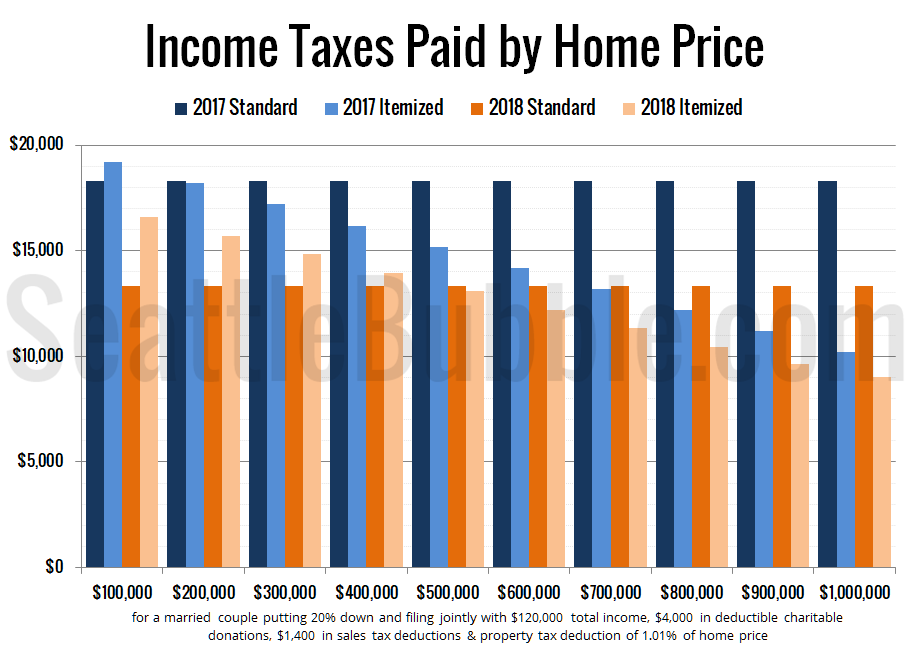

Let’s finish off our discussion of how the Seattle-area real estate market may be affected next year by the changes to the tax code. In yesterday’s post we discussed the doubling of the standard deduction, and concluded that it is likely to have very little effect. Today let’s look at the other two big changes: The reduction of the mortgage interest deduction cap from $1M to $750k and the capping of local sales, income, and property tax deductions at $10k…

Tag: tax deduction

Will the new tax laws slow Seattle’s housing market? (Part 1: Doubled Standard Deduction)

Now that the big GOP tax plan has passed, let’s have a look at how it may affect the Seattle-area real estate market next year when it goes into effect.

There are two major changes to the tax code that will matter to home buyers and home owners: the doubling of the standard deduction (from $12,700 for a married couple in 2017 to $24,000 in 2018) and the reduction of the mortgage interest deduction cap from $1 million to $750k.

First up let’s look at the doubling of the standard deduction…

Are Obama & Romney Avoiding Housing to Avoid Talking About Killing the Mortgage Interest Deduction?

There is one major political topic that has been mysteriously absent from both major presidential campaigns during this year’s presidential election season… housing. Nick Timiraos noted this in the Wall Street Journal in early September. Here we are in late October, four debates later, and nothing has really changed. Barely a peep about housing from…

Poll: Should the mortgage interest deduction be eliminated?

This poll was active 10.23.2011 through 10.29.2011.

Running the Numbers on the Flat Homeowner Deduction

[Read Part 1: Proposal: Replace the Mortgage Interest Deduction with a Flat Homeowner Deduction] In the comments on the proposal I made yesterday, Doug asked a reasonable question: Have you figured out what the deduction would be if you did this, and made it deficit neutral? That would be an interesting exercise. Good question. Let’s…