Apparently over at WSU there’s a group called the Washington Center for Real Estate Research. Last week they released a report on home sales in the first quarter of 2006 in the state of Washington. Surprise surprise, the report shows that home sales are slowing down in Washington! But as the Associated Press is all too happy to remind us, “prices continued to climb.”

There are signs the pace of home sales in Washington is slowing down, but prices continued to climb in the first quarter of 2006, according to the Washington Center for Real Estate Research at Washington State University.

…

The report is produced in conjuction (sic) with Washington Realtors.[Center director Glenn] Crellin said the raising of interest rates by the Federal Reserve Board is the main reason for the flat statewide market.

But he cautioned that the market appears flat only in comparison to the superheated housing sales of recent years.

“The market remains very strong,” he said, especially compared with the rest of the country.

…

Buying a house continues to become more difficult in Washington.The Housing Affordability Index – which measures the ability of a middle income family to buy a median price home with a 30-year mortgage – slipped further below 100 in the first quarter.

The statewide rate of 93.3 meant that a typical family had only 93 percent of the income required to buy a median-price home. Buyers in seven counties faced index values below 100, with the problem especially big in San Juan, Jefferson and King counties, which had values ranging from 37.1 to 77.1.

The full numbers from the report are available in PDF form directly from the WCRER. In my opinion, the most important bit of the report is the “affordability index,” which is described by WCRER as follows:

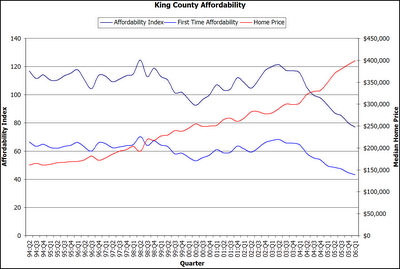

Affordability index measures ability of typical family to make payments on median price resale home assumes 20% down payment. First time buyer affordability assumes a less expensive home, lower downpayment and lower income.

A score of 100 means that the “typical family” can afford the median home. Take note that the “first time buyer affordability” rating in King County is just 43 percent. Not that this is particularly new information, I just think it needs to get more press. Seattle has basically become a place where only the rich (or those who already own) can afford to buy a home. Apparently the local press doesn’t have a problem with that.

The Affordability Index has never really been all that great for first time homebuyers in King County, hovering between about 60 and 70 from the early nineties through about 2003, but ever since then it’s just been tanking. Take a look:

I created this graph using the WCRER Build Your Own Report tool, which has data for the Washington housing market going back through 1994. For reference, I have overlaid the median home price (red line). You can see that as soon as the median price started shooting up at an abnormal rate, the affordability index began plummeting.

Rah, rah, real estate!

(Nicholas K. Geranios, Associated Press, 05.16.2006)