Another coworker of mine just put the family house up for sale. They are asking $490,000 for their 2,000 square foot home built in 1998 on 0.35 acres in rural eastern King County. They purchased in July of last year for $410,000. The previous owner bought from the builder for $240,000 in 1998, and sold 7 years later for a 71% profit. Dang.

They are selling because they are moving to northern California in late July because they both got “good jobs” there. Although the town they’re moving to is relatively rural and a decent distance from San Francisco and Sacramento, I can still see why they would want to squeeze as much cash as possible out of the place.

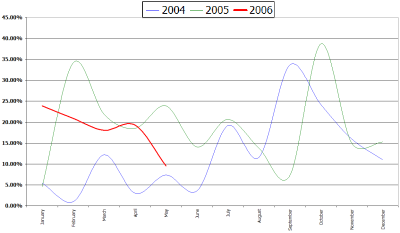

May NWMLS stats show area 550 (which contains their house) as having a 23.7% increase in inventory and a 11.5% decrease in sales compared to last year, with the median price increasing by “just” 9.5% (compared to a 16.9% increase for King County as a whole). Here’s a graph of the monthly year-on-year percent change in median price for area 550 for 2004-present:

Note the obvious downward trend of 2006’s red line compared to 2004 and 2005 around the same time of year. Is it just me, or does their asking price of $490,000 (which calculates out to a markup of 19.5% over what they paid just 11 months ago) seem extremely… shall we say, ambitious? If I were a more prying person I would ask them whether that price was suggested to them by their real estate agent or if they came up with it on their own. If it was their agent, they should fire him. Either way, I will be quite shocked if they are able to sell without a considerable markdown, but I would also be surprised if they can’t sell it for at least 5% more than what they paid. I’ll go out on a limb and predict a selling price of $430,000. Of course how much they end up getting will depend largely upon whether they absolutely need to sell before they move.

This brings up an interesting question. My coworker told me that when they bought the house last year “we had no idea that we would both be moving to California in a year.” If/when the market takes a tumble, what will people like my coworker do? Will they just not consider jobs outside their area? Will they somehow manage to sell at a loss and move anyway? Or will they attempt to rent out their house (probably also at a loss) while they wait out the market? Not everyone can just wait out the storm. Many people have compelling reasons that force them to sell their house. The argument that people just won’t sell their homes if the market starts to dip, thus preventing the market from dipping further doesn’t seem to hold water to me.