The prediction (emphasis added):

When July’s housing stats came out last week, the most confusing piece of data was that despite skyrocketing local inventory and tightening lending across the nation, the median price still jumped up 2.3% from June, bouncing back into double-digit YOY territory at a 10.6% increase since July 2006.

…

I believe that almost all of last month’s increase in the county-wide median can be attributed to this spike in sales on the Eastside.

…

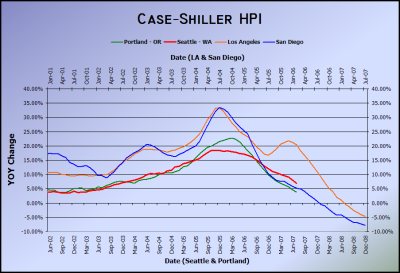

I don’t think this explains away all of the median price increase over the last few months, but I do think it accounts for a good portion of it, especially last month. In theory, if sales distributions are indeed skewing the median, we should see the YOY change in the Case-Shiller Index begin to diverge from the YOY change in the median, since the Case-Shiller method avoids this particular shortcoming. I’ll keep you posted when July Case-Shiller data is released.

– Median Price Not Telling the Whole Truth, August 14

The data (available here):

Case-Shiller Home Price Index up 0.2% June to July, 6.86% YOY.

I don’t mind saying once in a while that it feels good to be right. I’ll try not to let it go to my head.

Here’s the usual graph, with L.A. & San Diego offset from Seattle & Portland by 17 months, to give you an idea of how closely we’re following their lead:

There’s really not much else to say about the latest data. It shows pretty much exactly what I’ve been expecting. Let’s just say that we’re currently on track for a very interesting spring.