A couple people pointed me to a great article in today’s Wall Street Journal on the prevalence of sub-prime lending across the country over the last few years. The article discusses the surge in such risky loans, and the fallout that is already underway and likely to continue.

The data suggest that financial suffering is likely to persist in many parts of the U.S. where subprime lending had surged. Many loans at risk of going bad have not yet done so. As much as $600 billion of adjustable-rate subprime loans, for example, are due to adjust to higher rates by the end of 2008, which means that more and more borrowers are likely to fall behind.

Attached to the article is a nifty interactive graphic that shows just how widespread subprime lending has become since 2004. Here’s a bit about the methodology they used:

High-rate loans are defined as those having an annual percentage rate of at least three percentage points above a Treasury security of comparable maturity for first-lien loans and five percentage points for second-lien loans. Lenders have been required to report pricing details on high-rate loans since 2004. High-rate loans are considered to include many, but not all, subprime loans.

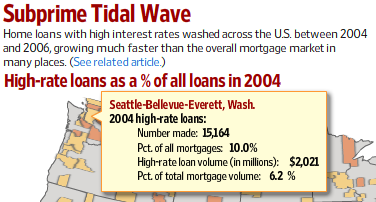

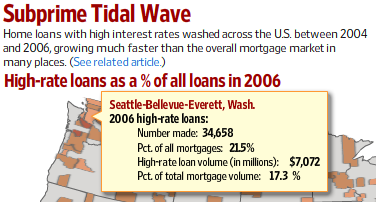

So how does the Seattle area stack up? Obviously we didn’t have nearly the amount of sub-prime lending as other parts of the country, such as Miami, Orlando, Las Vegas, or Los Angeles, where sub-prime made up over 30% of all mortgages in 2006. But we still experienced plenty of a “surge” of our own:

2004

2005

2006

Yup, sub-prime lending more than doubled as a percentage of the total mortgage market in the Seattle area. Tacoma was even worse, clocking in with 31% of all loans being sub-prime in 2006, earning them special mention in the WSJ article.

Lest you think that 20% is a low enough number to keep us out of trouble when the appreciation music stops, consider San Diego’s sub-prime stats for the same period (2004-2006): 8.1%, 19.1%, 22.7%. So no, sub-prime lending itself does not precipitate the decline of home prices. But once home prices do start to decline, even having 10-20% of recent mortgages being sub-prime can result in skyrocketing foreclosures.

Am I saying that things in Seattle will shake down exactly like they have in other places (such as San Diego) with similar statistics? Of course not. All I’m saying is that if they do, no one should be surprised. The real estate “professionals” that are frequently quoted in the media keep saying that the market is different enough in Seattle to protect home prices from falling, but every time we see the real data, such statements appear to be nothing more than wishful thinking.

(Rick Brooks & Constance Mitchell Ford, Wall Street Journal, 10.11.2007)

(Interactive Graphic, Wall Street Journal, 10.11.2007)