The latest data from Case-Shiller has been released. Here’s a blurb from the press release:

“At both the national and metro area levels, the fall in home prices is showing no real signs of a slowdown or turnaround,” says Robert J. Shiller, Chief Economist at MacroMarkets LLC. “Year-over-year and monthly price returns are continuing to either move deeper into negative territory or are experiencing persistent diminishing returns. There is really no positive news in today’s report, as most of the metro areas are showing declining or vanishing returns on both an annual and monthly basis. Only two metro areas – Denver and Detroit – showed improvement in their annual returns and even those were reports of slightly less negative numbers.”

Notice that Mr. Shiller did not make any exceptions for the specialness of Seattle or Portland. Go figure. Here’s the summary for Seattle’s latest data:

Case-Shiller Home Price Index fractionally down July to August. Up 5.66% YOY.

Although it is only a fraction of a point, this marks only the second month-to-month decline since 2003. One year prior, the YOY change was +16.11%. We will see where this trend leads…

For comparison, the NWMLS King County SFH Median for August was up 9.73%. This continues the trend of diverging data that began in earnest last month. Also keep in mind that since Case-Shiller tracks only same-house sales, the seasonal trends of declining sales in the late summer and winter have less of an effect on the numbers.

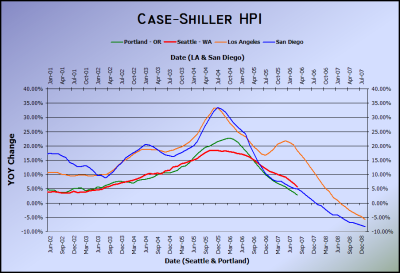

Here’s the usual graph, with L.A. & San Diego offset from Seattle & Portland by 17 months.

Is this graph predictive? Obviously not necessarily. I consider it more of a warning. However, the downward slope of Seattle’s line has so far been following pretty closely with where San Diego’s line went a year and a half ago (and still falling faster than L.A.). I’m still waiting for it to break off and “level out” like the real estate professionals have been promising it would.

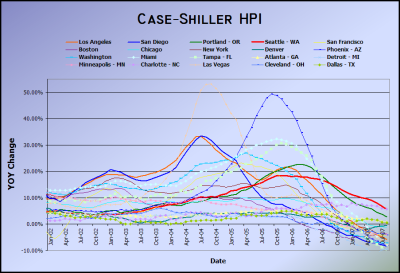

Just for good measure, here’s an update of the graph with all 20 Case-Shiller-tracked cities, with no time-shifting.

(MacroMarkets, Standard & Poors, 10.30.2007)