As I’m sure you all know by now, yesterday the Federal Reserve cut the benchmark interest rate again. While this move will no doubt feed the false hope for a speedy end to the housing slump, there is likely nothing the Fed can do that will stop the bubble from deflating.

However, when I step back and look at the big picture, I can’t help but be a bit concerned about the effect the recent rate cuts will have on my dollars. Over the past year, the value of the dollar has already fallen over 10%, with the steepest declines immediately following the September Fed cut of 50bps:

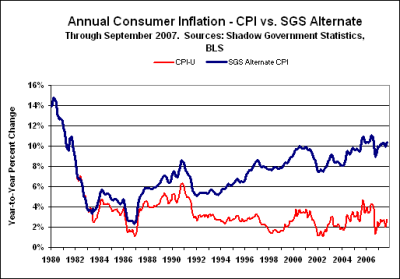

Meanwhile, the government is reporting mild inflation in the 2-3% range, but when calculated using the method from 1980, we’re actually sitting on over 10% inflation.

So on the one hand, you have the government telling us that basically everything is fine, the economy is humming along nicely, inflation is under control, and housing—while definitely a bit of a drag right now—is sure to pick back up soon. On the other hand, you have bloggers and economic commentators that see us moving toward hyper-inflation and dollar “destruction.”

I’m not trying to be alarmist here, because frankly, I don’t follow this big picture stuff closely enough to have a good handle on what is really going on. However, given the unimpressive recent record of “economists” and government mouthpieces when it comes to predicting the direction of housing and the economy, I’m inclined to believe that the bloggers may be closer to the truth.

So let’s say that extreme inflation / dollar devaluation is indeed around the corner (or already upon us). What do we as financially responsible, saving individuals do to avoid having our savings become worthless? Socking away all the money we’re saving on rent into a 5-6% CD doesn’t do much good if inflation is 10% (or higher). Knowledge is power, and if we have the knowledge of major economic changes headed our way, we should use that to our advantage. The only question is how.

I don’t have any good answers here. I’m just thinking out loud, and hoping to spur a discussion that can be productive for all of us. So, what are some answers?