Time to clear out my inbox. Following is a handful of short excerpts from things I’ve been emailed in the last few weeks. Enjoy.

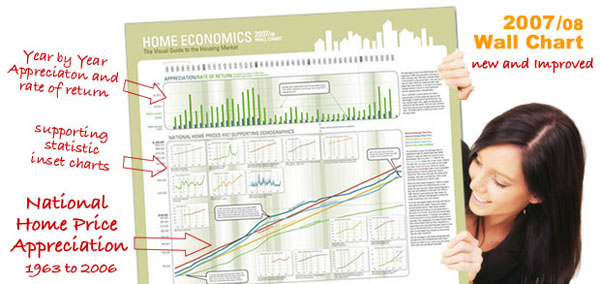

First up, a delightful “Home Economics Wall Chart” that is designed to “focus the consumer on the benefits of owning.” It’s Estate of Mind, Inc.’s Visual Guide to the Housing Market. Here’s an excerpt from their marketing email:

Now is the time. Although Washington state has been spared any major downturn so far, consumer confidence in the housing market has waned. Not a day goes by that your clients and prospects aren’t barraged with doom & gloom from the national media. Yet real estate is not day trading. Month to month variations in value are largely unimportant and ultimately inconsequential; nonetheless this reporting dominates the news and the public’s mindset.

…

Estate of Mind’s Chart provides a visual depiction and captioned explanation of not only the historical performance of real estate across the whole country, by region and by state; it also provides visual evidence of the factors like simple population growth and income trends that have traditionally fueled the market.

There’s nothing like a little bit of delicious propaganda. Don’t get me wrong, home ownership is great, but I love how their email includes lines such as “factors like simple population growth and income trends that have traditionally fueled the market,” while conveniently ignoring how incredibly detached prices have become from these “traditional factors” in recent years.

Moving on, another reader makes the following comment about Seattle’s market:

I don’t think the bubble has burst in Seattle at all. Anything in Green Lake (and I do mean anything–shacks, huts, etc.) priced around $550K is gone in a flash… same for Capitol Hill and Queen Anne. Anything in Ballard for around $500K is gone in a week. So, lot’s of buying going on and the buyers are shelling out big bucks, so looks like we’re going to have to go way north or way south to afford anything. I don’t get it really, but it’s what’s happening out there.

As we have been demonstrating with the neighborhood breakdown posts, it is indeed true that the neighborhoods in North Seattle are much softer than last year, but still not nearly as soft as the rest of King County. Personally I think they will get a real slowdown, it will just reach those areas last.

Here’s a related comment from another reader:

It was your site that I had looked at and at first (as a know-little fool), scoffed at, but the truth is, I think we’re (Seattle) like the last few floors of the Titanic.

A Washington Post publicist emailed me a link to a cartoon that illustrates how the behind-the-scenes trading of mortgage securities turned into a big mess for everyone.

And lastly, here’s a bit about foreclosures from yesterday’s P-I:

Foreclosures have increased in King County, but they have not yet peaked locally or nationally, according to a new report.

The number of properties facing foreclosure in February was up 37 percent in Washington and 60 percent nationwide from a year earlier, according to RealtyTrac, an Irvine, Calif., company that tracks foreclosures.

Foreclosures dropped 4 percent nationally in February, but that’s less than last year’s January-to-February drop.

Meanwhile, foreclosures were up 0.9 percent in Washington from January, and King County foreclosures rose 7.6 percent from January.

RealtyTrac could not provide a reliable figure for King County’s year-to-year change because of a problem with its data collection last year.

But notices of trustee sale, which are the first step in the foreclosure process, were up 104 percent in February from a year earlier, according to county records.

The state’s rate of one filing per 1,194 households put it 28th among states and was less than half the national rate of one per 557 households.

The Seattle area, which RealtyTrac considers King and Snohomish counties, had one filing per 1,450 households in February, putting it 166 out of 229 metropolitan areas. That was up from 173rd place in January.

I still don’t really understand how anyone can be facing foreclosure in the Seattle area if the market is still as strong as the real estate agents would have us believe. You don’t end up in foreclosure if you can just sell your house for 10% more than you bought it for last year, right?

(Estate of Mind, Inc., 2008)

(Laura Stanton, Washington Post, 03.14.2008)

(Aubrey Cohen, Seattle P-I, 03.12.2008)