Now that prices are undeniably dropping in Seattle, a common refrain from real estate salespeople is that “you can’t time the bottom,” or “you can’t predict the future,” implying that you should go ahead and just buy now, because we’re probably at or near the bottom already, and if you wait you’ll be sorry.

This is an interesting line of reasoning, but while it is true that no one can know with certainty what the future holds, blindly making a gut decision based on our lack of knowledge would be foolish. Instead, we can and should consider the different possibilities and base our decision on a rational analysis of what we do know.

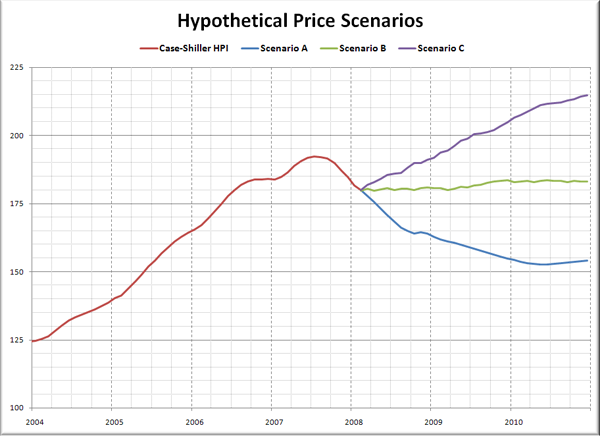

So let’s look at three different possibilities for where prices might go from here, and look at what it would mean if you buy now versus if you continue to rent a while longer, waiting for either two years, or six consecutive months of price increases before you decide to buy, whichever comes first.

Scenario A: We’re not at the bottom yet. Prices continue to decline, eventually bottoming out at summer 2005 levels in the summer of 2010. Prices begin to inch up slightly through the end of 2010.

Scenario B: We’re at the bottom, but we’ll be here for a while. Prices stay more or less flat through 2010, increasing no more than about 1% per year.

Scenario C: We’re at the bottom. Prices begin to increase again, rising 5-7% YOY through 2010 and beyond.

In our hypothetical scenario, let’s say that you are looking at a $450,000 house, you have the 20% down ($90,000), can afford a fixed-rate 30-year loan, and your alternative is to rent for a monthly cost of $1,500 (increasing 5% per year). There are comparable houses for sale and rent right now in Ballard that fall within these specifications, so I think they’re reasonable.

Scenario A

Buy now: Your total monthly costs are around $3,000. The value of your home decreases around 15% by 2010. If you have to sell, agent fees and excise taxes will eat up most of the $30,000 that remains of your down payment. If you don’t have to sell, who cares what it’s worth—enjoy your house and the (mostly) fixed payments.

Rent for now: Your rent increases to $1,650 per month by 2010, and if you save the extra money you would have put into the mortgage every month, and invest your $90,000 down payment at 5%, your savings has increased to $125,000 by that time. You see the prices start to increase again, and after six months of steady increases, you decide that now is the time to buy. Houses that would have formerly sold for $450,000 are now $380,000, allowing you to put down over 30%. Your total monthly costs are around $2,300 at 6% interest, $2,500 at 7%.

Advantage: Rent for now

Scenario B

Buy now: Monthly costs are $3,000. The value of your home stays more or less flat through 2010. If you have to sell, you’ll get back about $70,000 of your down payment after agent fees and excise taxes. If you don’t have to sell, who cares?

Rent for now: Rent goes up to $1,650, savings to $125,000. You decide to finally take the plunge on that house, and you can get one for $455,000 that is just like the one you were considering before. Your total monthly costs are around $2,750 at 6% interest, $2,900 at 7% interest.

Advantage: We’ll call it a wash (depends on future interest rate)

Scenario C

Buy now: Monthly costs are $3,000. The value of your home increases around 12% by 2010. If you have to sell, you get to pocket over $115,000. If you don’t have to sell—well, you know the drill.

Rent for now: You save six month’s worth of payments before realizing that prices are already going up again. Homes that were $450,000 are now $465,000. Your down payment investment has gone up slightly to $99,000. Your monthly costs are around $3,000 at 6% interest, $3,150 at 7%.

Advantage: Again, more or less a wash (also depends on your interest rate)

Of course, I don’t personally believe that all three of those scenarios are equally likely, but even if they were, there still is no real benefit to buying now. Even if we’re currently at the bottom and prices start climbing relatively quickly starting now, you’re really no worse off for waiting six months to find that out.

The biggest factor that makes this a feasible strategy is the continued large discrepancy between rents and home payments. I’m sure a skilled real estate salesperson could concoct some scenario in which waiting out the market right now is a foolish financial move, but based on this analysis of three fairly reasonable possibilities, I’m comfortable recommending that course of action for the time being.