A couple people pointed out a piece in the Wall Street Journal yesterday titled The Housing Crisis Is Over. I don’t doubt that the mere fact that it was printed in the WSJ makes it gospel to some folks. I am not interested in writing a rebuttal to this piece, as that has already been handled quite well by our friends at Calculated Risk. All I would like to add is to point out that this is an opinion piece, not a news article. In the opinion of a guy that runs a hedge fund and stands to profit healthily from the recovery of the housing market, the crisis is over. Not exactly a shocking revelation.

Meanwhile, Fannie Mae, “the nation’s largest buyer of home mortgages” announced huge losses today, and forecasts “a steeper drop in home prices this year.” Yeah, the crisis is over folks, nothing to see here, move along.

In other news, Les Christie of CNNMoney.com is singing a bit of a different tune than she was in mid-2006, when she was touting our “strong fundamentals” and declaring Washington State to be the “next hot market,” or just last summer, as the local market was hitting its peak, when she declared that in Seattle, “the housing boom goes on.” Her latest headline is not quite as positive: Bulletproof housing markets get hit.

Some of the last, best housing markets – the ones that continued to climb even as the rest of the country cratered – have turned south lately.

Seattle, Portland Ore., Charlotte, NC, and Salt Lake City all posted home price gains during 2007, even as more than half of the 150 markets tracked by the National Association of Realtors registered declines. Now they’ve joined the losers.

Of course, the Seattle market was never “bulletproof,” just late.

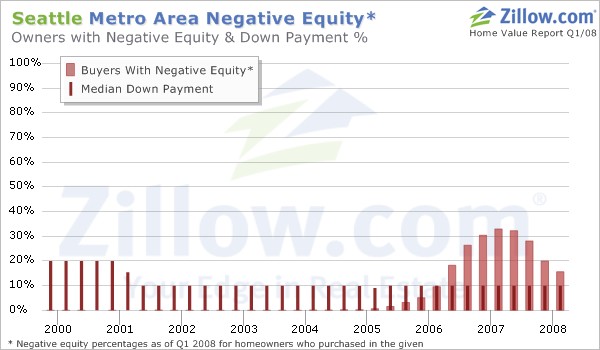

Speaking of the local decline, Zillow released their latest Quarterly Home Value Reports this week, which contain some interesting information about our area’s market. Of particular interest is the chart showing the approximate percentage of homeowners who bought each year that now have negative equity:

There’s also a corresponding map on the charts page showing how all that negative equity is distributed around the region. Interesting stuff.

I think that’s enough to digest in one post.

(Cyril Moulle-Berteaux, The Wall Street Journal, 05.06.2008)

(CR, Calculated Risk, 05.06.2008)

(Les Christie, CNNMoney, 05.06.2008)

(Quarterly Home Value Reports, Zillow, 05.05.2008)