It’s time for NWMLS statistics. Let’s have a look at how May turned out.

Update: The NWMLS press release is now live, with a headline that does not disappoint: Northwest MLS Brokers Report Buyers Slow to Take Advantage of Market Conditions. You can download the latest stats pdfs there as well.

Here is your summary along with the usual graphs and other updates.

Here’s your King County SFH summary:

May 2008

Active Listings: up 42% YOY

Pending Sales: down 39% YOY (new record)

Median Closed Price*: $440,000 – down 6.2% YOY (new record)

Here is the updated Seattle Bubble Spreadsheet, and here’s a copy in Excel 2003 format. Click below for the graphs and the rest of the post.

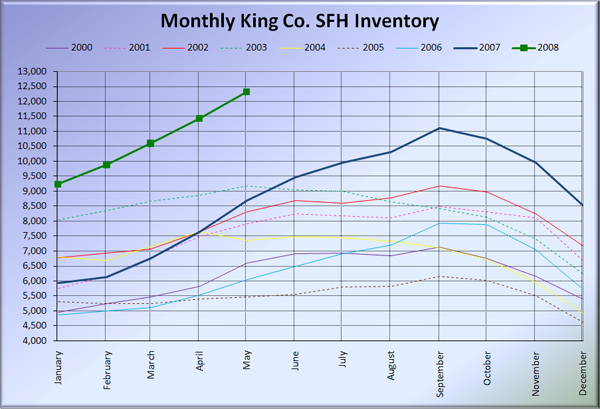

Here’s the graph of inventory with each year overlaid on the same chart. I had to adjust the vertical axis range to accomodate the fact that inventory continues to set new records monthly. Yowza.

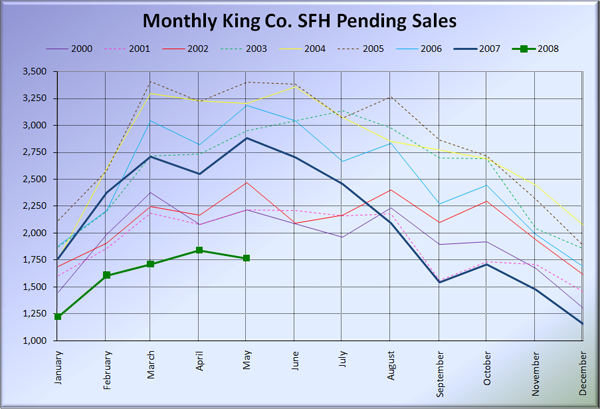

Sales dropped from April to May, only the second time this has happened since 2000. However, sales from March to April increased, which is equally uncommon, so it would appear that the bump in April sales simply borrowed some buyers from May. Note that not only were May sales down a record-breaking 39% over last year, but they also came in 20% lower than the prior record-low sales volume for May set in 2000.

Thanks to the big drop in sales, months of supply (active listings divided by pending sales) jumped up a bit to 7.0. May is now the ninth straight month of MOS above 6 (considered a buyer’s market) for King County SFH.

We’re still quite a ways from a “normal” housing market here.

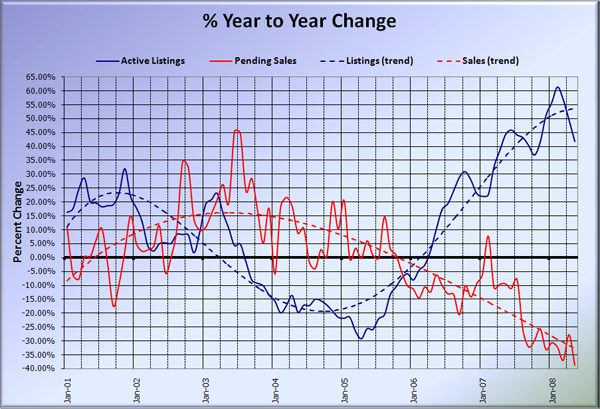

Here’s the supply/demand YOY graph.

Had to adjust the vertical scale on this one as well due to the record drop in sales.

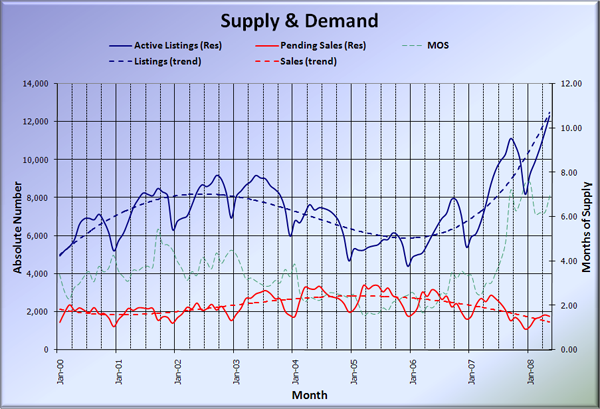

Here’s the chart of supply and demand raw numbers:

Increased the vertical scale to account for the record number of listings.

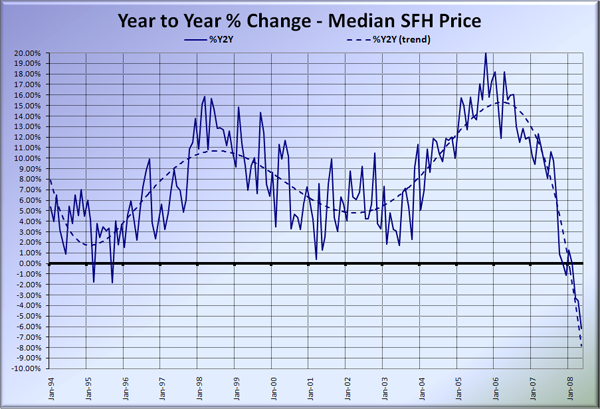

Here’s the SFH Median YOY change graph.

And yet another one I had to adjust the vertical scale on, to adjust for the record-breaking decline in prices. Who could have possibly seen this coming?

Well, it doesn’t look like April was the bottom after all. I wonder if we’ll get to read some entertaining quotes from local agents about “foot traffic at open houses” and how the market is “set to rebound.” Stay tuned.

Update: Here are a few excerpts from the blurbs from the Seattle Times and the P-I.

Seattle Times: House prices fall again in May; Seattle condo prices up

…while real-estate firms tout this spring as an ideal time to buy because the selection of homes is larger than it’s been in years and sellers are ready to deal, buyers apparently remain unconvinced.

…

“Open-house traffic is picking up, and buyers are coming off the sidelines to make buying decisions,” Dick Beeson, broker/owner at Windermere/Commencement Associates in Tacoma said in a statement.Beeson credits the activity to buyers realizing that interest rates could creep up, canceling any gain they might see by waiting to prices to fall further.

Ha, sweet. Already with the “open house traffic” nonsense, plus some fear-mongering thrown in for good measure. I love it.

Seattle P-I: King County house prices drop

Area home sellers appear to be blinking first in what has been a months-long standoff with buyers.

…

The price drop has “already happened,” said Mike Skahen, broker of Lake & Co. Real Estate. “It’s a great time to negotiate with sellers.”He reported a noticeable pickup in close-in Seattle markets and blamed slowness on negative press reports.

Dick Beeson, broker/owner of Windermere/Commencement Associates, in Tacoma, blamed the gray weather.

“We still haven’t had summer hit us yet as the weather remains cool, wet and cloudy,” he said. “I expect both temperatures and the market to heat up as summer approaches.”

This stuff is seriously hilarious.