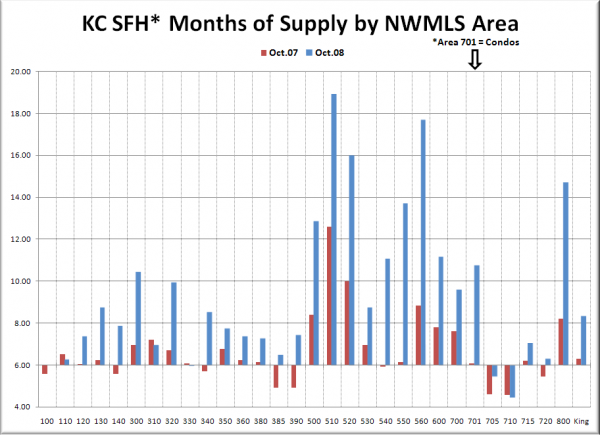

Let’s have a look at “Months of Supply” for the 30 NWMLS areas in King County. For an explanation of what months of supply means, please refer to the original neighborhood MOS breakdown post. Also, view a map of these areas here.

October MOS for King County as a whole came in at 8.33 (compared to 6.29 for October 2007 and 6.57 for September), bringing the current run of 6+ MOS to fourteen months—by far the longest King County has ever seen.

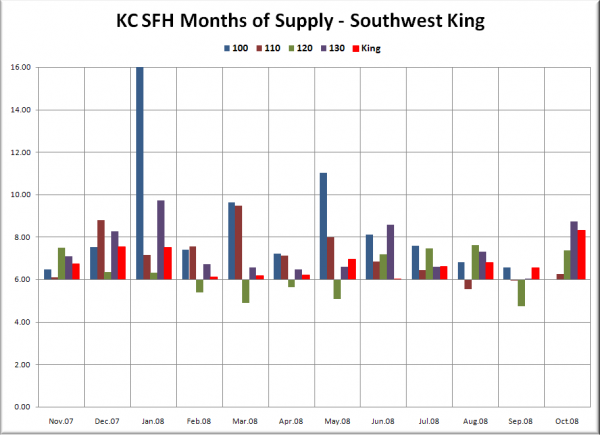

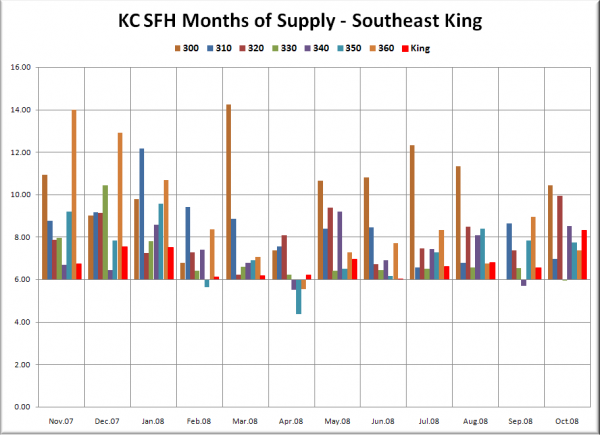

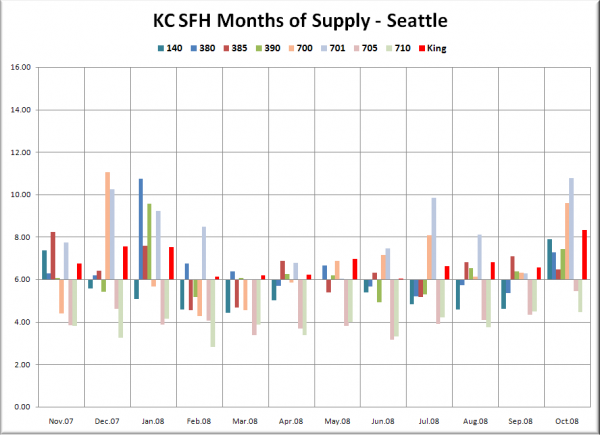

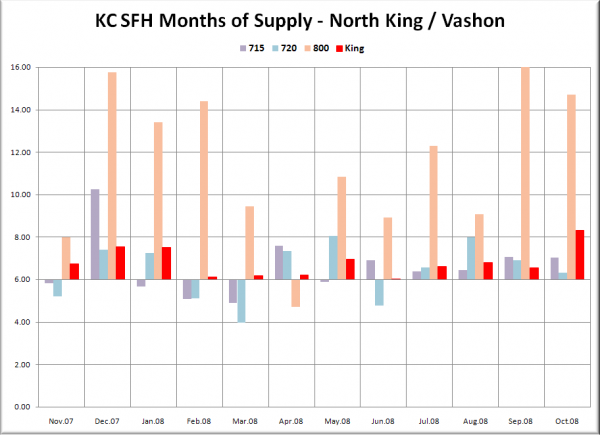

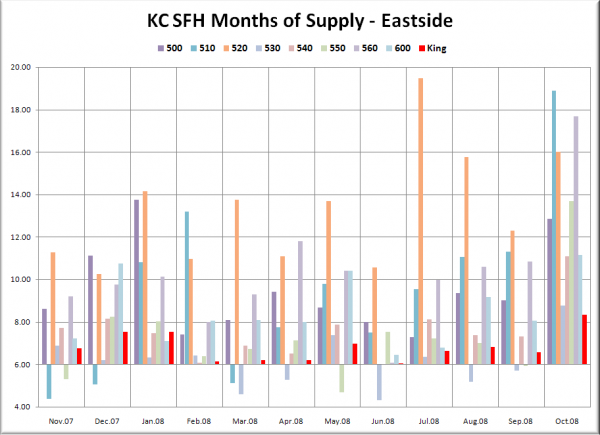

In the graphs below, you’re looking at the MOS for the “Res Only” data from the NWMLS King County Breakout pdfs for the one-year period of November 2007 through October 2008. The bar graph is centered vertically on 6.0 MOS, so that it is easier to visually tell the difference between a seller’s and buyer’s market (i.e. – shorter bars mean a more balanced market). Each graph again has the same scale on the vertical axis and has the King County aggregate figure plotted in red on the far right, so they can be easily compared.

Note that there are a few areas that appear to have no bar at all for a given month—this represents an MOS value at or close to 6.0. Also keep in mind that whatever the reason, pending sales have become increasingly disconnected from closed sales recently, which means that these statistics are likely understating the magnitude of the “buyer’s market.”

We’ll start off with the chart that lets you directly compare each area’s MOS to its value one year ago. October 2007 is in red, and 2008 is in blue.

Following below are the breakouts for SW King, SE King, Seattle, N King, and the Eastside, as well as a summary of this month’s data.

Note: Area 100 (Jovita/West Hill Auburn) was over 21 in January, and has been clipped.

Note: For Area 701 (Downtown Seattle) we’re using condo data.

Note: Area 800 (Vashon Island) was over 17 in September, and has been clipped.

Note: The vertical scale on the Eastside graph was adjusted to fit the multiple areas with 16+ MOS.

Only three of thirty King County areas were in seller’s market territory in October, ranging from 4.47 MOS in 710 (UW, Wedgewood, Lake City) to 5.94 MOS in 330 (Kent). The city of Seattle was still the region closest to an overall seller’s market, although only two of eight areas came in below 6 MOS.

The cumulative MOS for Seattle proper bumped up from a seller’s market of 5.13 in September to a buyer’s market of 6.74 in October, the first time in the recent slowdown that Seattle proper has been above 6 MOS. The Eastside as a whole shot up month-to-month and year-to-year to a staggering 12.42 MOS.

Only four of thirty neighborhoods trended more toward a seller’s market than a year ago. Ten neighborhoods were above 10 MOS, firmly in buyer’s market territory. I suspect these numbers will only get more dramatic as we head into the slow selling season of winter.

The three toughest markets for sellers were all on the Eastside: Mercer Island (510) at 18.90, Kirkland–Bridle Trails (560) at 17.68, and the old standby Medina / Clyde Hill / W. Bellevue (520) at 16.00. 520 continues its 10+ MOS streak, now at 14 months.

West Seattle (140) lost its place on the sellers market list, jumping from 4.61 to 7.88 in a single month. The three best markets for sellers as of last month were: North Seattle (710) at 4.47, Ballard/Greenlake/Greenwood (705) at 5.46, and Kent (330) at 5.94. No other market had less than 6.0 MOS last month, although Jovita/West Hill Auburn (100) did have exactly 6.0.