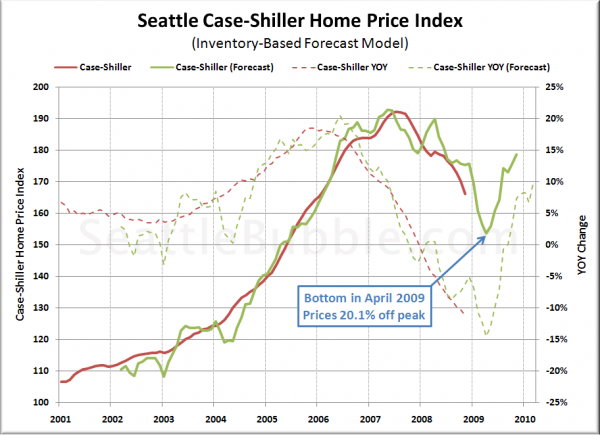

Long-time readers may recall Deejayoh’s inaugural Seattle Bubble article from June 2007: Why Inventory Matters. In it, he postulated that the Seattle-area Case-Shiller Home Price Index could be relatively accurately predicted fourteen months in advance by looking at year-over-year house inventory on the MLS.

Let’s extend Deejayoh’s analysis fourteen months into the future to see if it will predict a bottom.

Here are our basic assumptions for the Inventory-Based forecast (see Why Inventory Matters for more detail).

- Inventory changes forecast home price changes by 14 months.

- Equation: HomePricesYOY = (-0.386 * InventoryYOY) + 0.092

- I’ll be using King County SFH inventory only, as that provides the best fit through 2007 and 2008.

Given these assumptions, here’s a rough picture of what Seattle’s Case-Shiller Home Price Index would look like through late 2009:

Using the Inventory-Based forecast model, Seattle-area home prices (as measured by the Case-Shiller HPI) will hit a bottom early this year, and proceed with a sharp “V-shaped recovery,” ending the year well above their current levels.

As Deejayoh demonstrated in 2007, the Inventory-Based forecast model has a pretty good record from 2001 through 2007. However, the forecast for the coming year does not pass the “sniff test.” No other signs currently point to such a sharp recovery this year, despite what this model is predicting.

Unfortunately, it would appear that the Inventory-Based forecast model has reached the end of its useful life.

Method 1: Inventory-Based Forecast (Summary)

Bottom Month: April 2009

Bottom Value: 20.1% off peak

Likelihood*: 10%

* Likelihood is a totally subjective value assigned according to The Tim’s gut feeling. Treat it accordingly.

Bottom-Calling Week on Seattle Bubble

- Introduction: Bottom-Calling Week on Seattle Bubble

- Method 0: Blind Optimism

- Method 1: Inventory-Based Forecast

- Method 2: Dollars per Square Foot Linear Forecast

- Method 3: Simple Mirror Forecast

- Method 4: Affordability Index Forecast

- Method 5: San Diego Lag Forecast

- Conclusion: So Where’s the Bottom?