Here’s a brief quote from a post that appeared here in 2006 titled The Monthly Payment Buyer:

In my opinion, it’s no wonder that home prices have gotten so out of whack with true fundamentals, when the first question someone asks in the home buying process is not “Is this house worth $XXX,000?” but rather “Can I afford $X,000 per month (no matter what kind of financing it takes)?” Obviously a monthly payment must be affordable, but should that really be the sole determining factor in whether a house is worth buying?

With interest rates bouncing up in the last few weeks from their artificial lows in the 4s, it’s interesting to consider how this might affect the housing market.

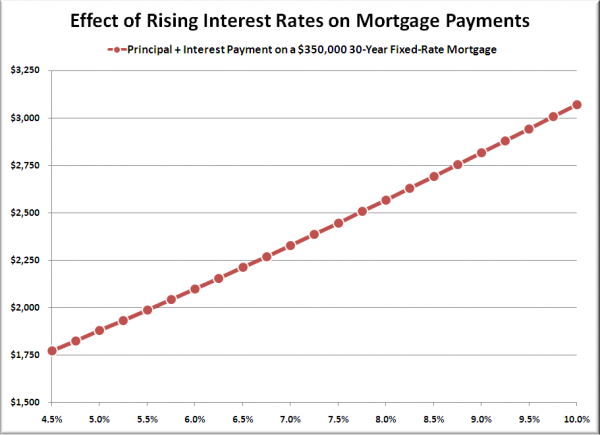

Following is a chart that shows how the monthly payment (principal + interest only) on a $350,000 mortgage grows as interest rates rise:

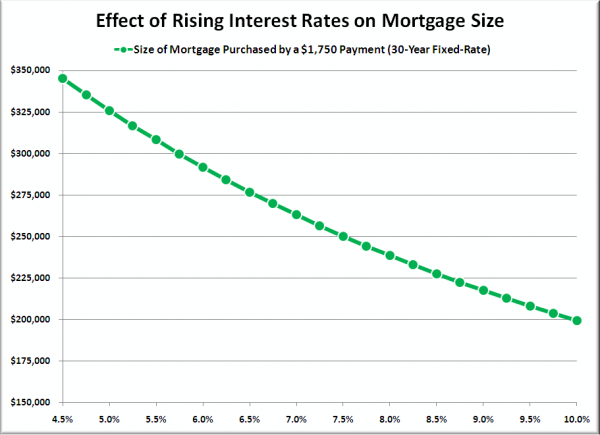

Since most people are still “monthly payment buyers” when it comes to buying real estate, perhaps more informative is the following chart, which shows how much mortgage a fixed $1,750 payment (principal + interest only) buys as interest rates rise:

A mere 1-point jump in interest rates from 4.5% to 5.5% drops the amount that can be afforded by over 10%. Another 1-point jump up to 6.5%—a rate considered great just a few years ago—knocks another 10% off.

If suddenly everyone in the buying pool can afford 10% less for a home, what effect do you suppose that might have on prices?