Astute readers have no doubt have learned by now of yesterday’s announcement by HUD Secretary Shaun Donovan that the federal government’s “Making Home Affordable” plan will now allow mortgages owned or guaranteed by Fannie Mae and Freddie Mac to be refinanced with loan-to-value ratios of up to 125%.

I won’t go into all the details of the announcement since you can find good coverage of the changes over at the P-I or Rain City Guide. Instead, I thought it would be interesting to see what the long-term financial picture might look like for someone who plans to take advantage of this program.

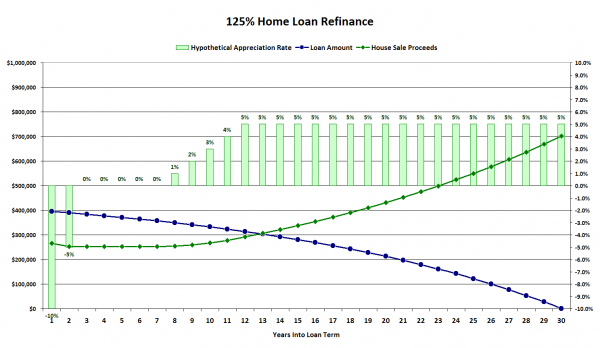

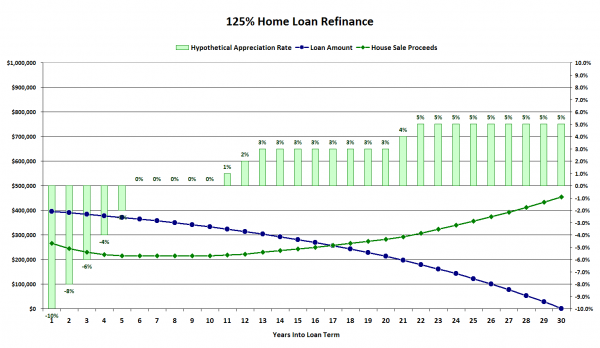

Let’s take a look at some hypothetical home borrowers who currently owe $400,000 in various mortgages with difficult terms or high rates, and whose home is presently worth $320,000. They jump on the new FHFA Home Affordable Refinance Program and refinance into a single 30-year fixed-rate loan at a 5.75% interest rate with a 125% loan-to-value ratio.

I hope that our hypothetical couple doesn’t want to move any time in the next 13 years, because under a relatively optimistic home value appreciation scenario that’s how long it will take before they will be able to sell without bringing money to the table:

Note that the home sale proceeds line assumes paying 6% of the sale price to real estate agents, as well as an additional 2% to account for excise taxes and other costs of selling. You can also download the spreadsheet I used to create these charts and tweak the values yourself.

With the home value appreciation tweaked to a slightly less rosy scenario, it takes 17 years before our couple can break even selling their house:

According to a 1993 study by the Census Bureau (pdf) only ~10% of home owners stayed in one house for over ten years. A 2001 study (pdf) by the NAR-funded Joint Center for Housing Studies put the median length of home ownership at 8.2 years. Refinancing one’s home into a 30-year loan for 125% of the house’s value will most likely lock the borrower into their present home for a period of time longer than 90% of people usually stay in their homes.

If the goal of this new 125% loan-to-value program is to financially imprison people in their current homes for a decade or more, then it looks like it could be a rousing success. However, I’m not sure how many currently struggling home borrowers would really consider that to be much of a “help.”