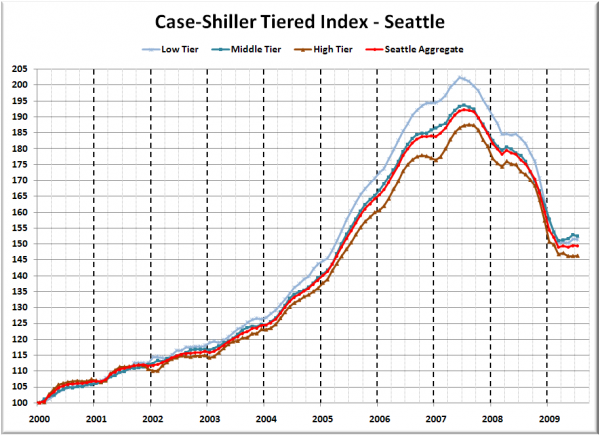

Let’s check out the three price tiers for the Seattle area, as measured by Case-Shiller. Remember, Case-Shiller’s “Seattle” data is based on single-family home repeat sales in King, Pierce, and Snohomish counties.

Note that the tiers are determined by sale volume. In other words, 1/3 of all sales fall into each tier. For more details on the tier methodologies, hit the full methodology pdf. Here are the current tier breakpoints:

- Low Tier: < $273,625

- Mid Tier: $273,625 – $402,694

- Hi Tier: > $402,694

The tier breakpoints shifted slightly upward again in July despite a decline in the overall index, which would seem to indicate a continuing shift in the sales mix of homes away from the low end toward the high end.

First up is the straight graph of the index from January 2000 through July 2009.

The high tier actually increased slightly from June to July, while the middle tier dropped the most. The “rewind” situation held steady for the month, with low tier sitting about where it was in April 2005 and the middle and the high tiers at May 2005 levels.

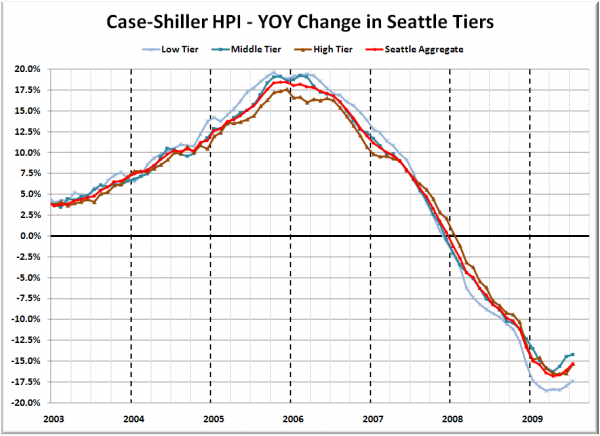

Here’s a chart of the year-over-year change in the index from January 2003 through July 2009.

With a month-to-month increase, the high tier’s year-over-year picture improved the most in July. Here’s where the tiers sit YOY as of July – Low: -17.4%, Med: -14.3%, Hi: -15.3%.

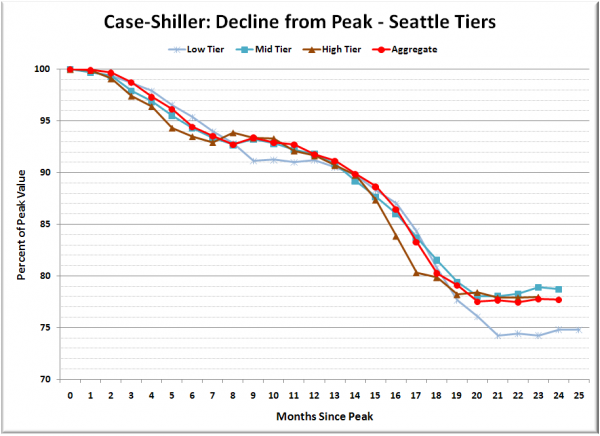

Lastly, here’s a decline-from-peak graph like the one posted yesterday, but looking only at the Seattle tiers.

The best recovery hundreds of billions of government “stimulus” can buy.

(Home Price Indices, Standard & Poor’s, 09.29.2009)