On Friday the Puget Sound Business Journal posted another great piece by Kirsten Grind on all the shady dealings that went on behind the scenes in the WaMu shutdown ordeal. The piece, titled The Washington Mutual decision is currently available on their site only to subscribers, but over on Portfolio.com (one of their sister sites) you can read the article in its entirety for free.

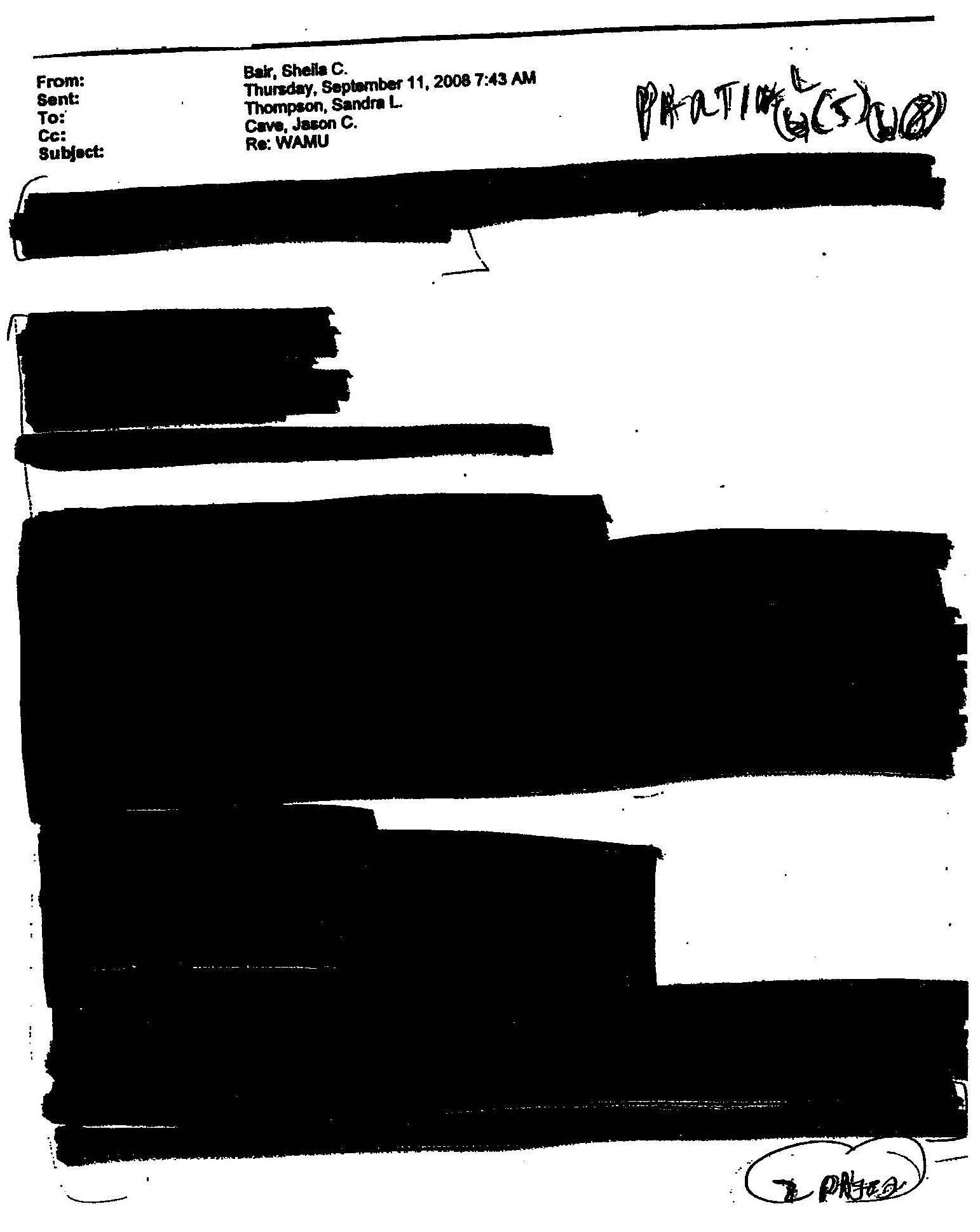

An example of the blacked out pages released by regulators in response to the Business Journal’s request under the Freedom of Information Act.

Something that I found really interesting about this story was posted over on the Business Journal blog BizTalk. The image at right is a sample page of the kind of materials that the FDIC released to the Puget Sound Business Journal in response to their Freedom of Information Act request.

According to Kirsten:

I received hundreds of blacked out emails from the FDIC and the OTS, WaMu’s primary regulatory, hasn’t sent any emails at all.

Does anybody happen to remember this, from back in January? On Day One, Obama Demands Open Government

All agencies should adopt a presumption in favor of disclosure, in order to renew their commitment to the principles embodied in FOIA, and to usher in a new era of open Government. The presumption of disclosure should be applied to all decisions involving FOIA.

I’m having a hard time reconciling the alleged “new era of open Government” and hundreds of blacked out emails received by the Business Journal. Must be some sort of Newspeak.

In other related WaMu news, someone posted a link to an interesting bankruptcy filing (pdf) over on the forums back in October that basically alleges that the WaMu shutdown was a lengthy con orchestrated by JPMorgan Chase through the federal regulatory agencies to allow JPMorgan Chase to acquire WaMu for a song.

Whatever went down behind the scenes in the months leading up to WaMu’s closure, it certainly seems to appear that it wasn’t all above-board.