I thought it might be useful to visualize just how much the government is involved in the housing market. Let’s look at how much a homebuyer receives via capital gains tax excemption for home sales, mortgage interest deduction, deductability of points paid on mortgage, and first-time buyers tax credit over 5 years, 15 years, and 30 years.

Here are the underlying assumptions I’ll be working from: $400,000 house, $1,600 / mo rent. 3% YOY home value appreciation, rent increases 2% YOY. Buyers are a married couple with good credit in 25% tax bracket. Home maintenance costs average 1% of purchase price per year. Utilities are equal between rented house and purchased house. No HOA dues. 3.5% down, 1 point paid on FHA 30-year fixed financing for an APR of 5.489%.

Scenario 1: Buy a house, stay in it for the duration of the mortgage, paying it off in 30 years.

Scenario 2: Buy a house, in 5 years, sell house and move to roughly equivalent house, putting down whatever extra money remains from the sale. Repeat every 5 years for 30 years.

Scenario 3: (baseline comparison) Rent for 30 years.

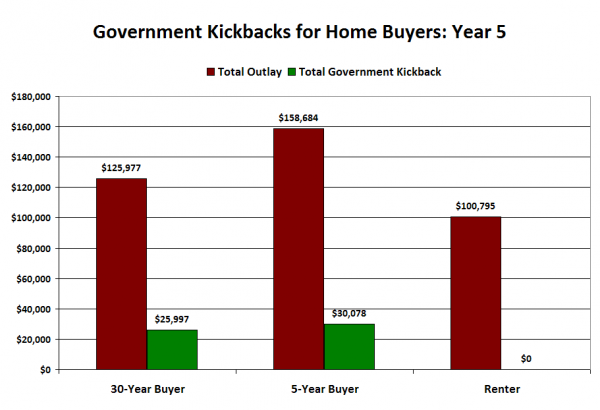

Here’s what the outlays and kickbacks look like for each scenario after 5 years (that’s one sale by the 5-year buyer):

Both the 30-year buyer (scenario 1) and the 5-year serial buyer (scenario 2) received the $8,000 tax credit and saved $17,997 in income taxes. The 5-year serial buyer saved an additional $4,081 in capital gains tax exemption.

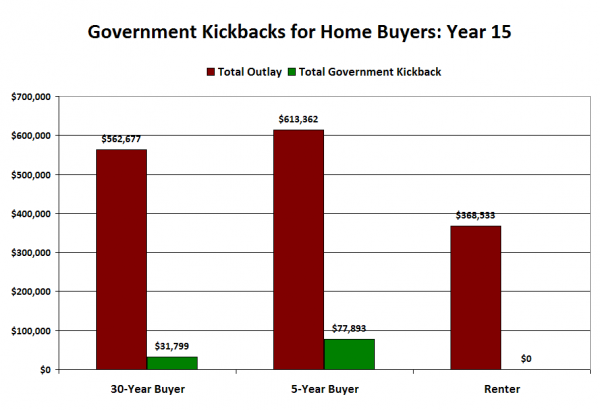

Here’s what it looks like after 15 years (3 sales by the 5-year buyer):

Since the 5-year serial buyer reset their mortgage interest amortization at 30 years three times, they have now saved $57,015 in income taxes vs. the 30-year buyer’s $23,799 savings. The 5-year serial buyer has also saved $12,878 with capital gains tax exemptions on three sales.

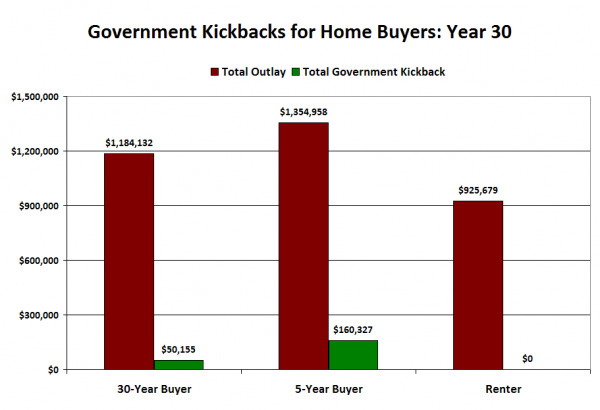

It gets even more lopsided after 30 years:

The 5-year serial buyer has saved over three times as much as the 30-year buyer. Granted, they paid an extra $171k in real estate fees and excise taxes to save $110k, but the government-sponsored “savings” provided an immediate gratification.

These numbers are obviously just rough estimates, and don’t take every single variable into account. The purpose is just to point out the approximate magnitude of the current government interventions on the financial bottom line for individuals in the housing market.

With the 30-year buyer in the above scenario receiving roughly $1,700 a year in tax incentives and the 5-year buyer getting $5,300 a year, there is obviously a strong government incentive to not only buy a house, but to become a serial purchaser, swapping houses every few years to maximize the realized “benefits” offered by good old Uncle Sam.

In my opinion, it’s no wonder the housing market has gotten so screwed up when the move most encouraged by the existing government incentive structure is to buy the most expensive house, finance as much as possible, and move to a new, more expensive house as often as possible, basically remaining in a state of permanent home indebtedness.

Thanks to Rhonda Porter for assistance in calculating the costs and rates for FHA financing used in this post.