A couple of readers alerted me to an interesting feature that has been added sometime recently to Google’s financial tools, the Google Real Estate Index. Obviously like most of the statistics provided by Google, this index tracks searches. Here is their description:

The Google Real Estate Index tracks queries related to “real estate, mortgage, rent, apartments” and so forth. To see more details on the queries that make up this index, visit Google Insights for Search.

The index is set to 1.0 on January 1, 2004 and is calculated and displayed below as a 7-day moving average. The index is currently calculated only for US search traffic.

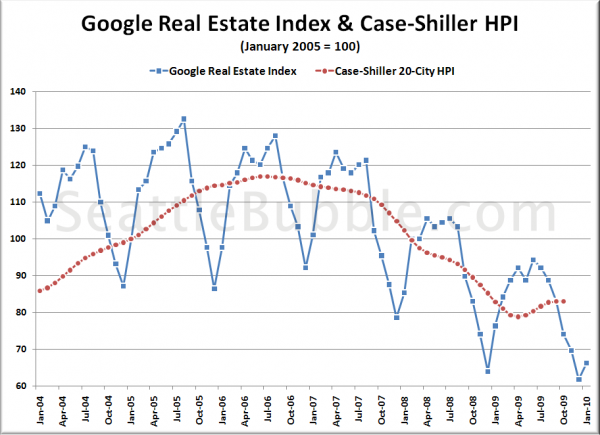

Since they provide the ability to download the underlying raw index data, I thought it might be interesting to compare this index with the Case-Shiller 20-city home price index. Here’s a plot of the two, both re-indexed to January 2005 = 100:

There definitely seems to be some similar behavior between the two there. This could be interesting, since the Google REI is updated every week, while we have to wait months for the Case-Shiller data. It is also worth noting that unlike some other measures of the real estate market, Google’s REI in 2009 did not manage to beat 2008, and continues to mark new seasonal lows as of the most recent data.

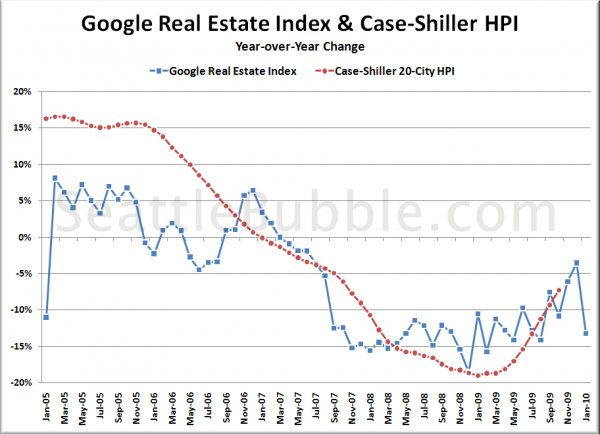

Here’s a look at the YOY change in both indices since 2005:

They both went firmly negative around the same time, in early 2007, and hit their lowest points in late 2008 / early 2009 at nearly -20%. Both have recovered somewhat, but the latest reading for the Google REI dropped back down to nearly =15% again.

Finally, here’s a look at the two indices again re-indexed to January 2005 = 100, but looking at the Google REI as a 12-month rolling average to smooth out the strong seasonal effects:

No sign there of a let-up yet in the decline. Based on Google’s measure of people’s interest, it would seem that the real estate market has yet to find a bottom. This data seems to square with a recent survey by The Conference Board that found that just 1.9% of Americans are currently in the market to buy a house, a 27-year low.

[Update] Commenter Rojo points out that using Google Insights for Search beta, you can look at a similar index specific to regional markets. Here’s their plot for Seattle-Tacoma along with the nationwide data. During much of the boom years, Seattle’s interest in real estate was higher than it was nationwide, but since 2008, we have been coming in 5-10 points lower.

Data Sources: