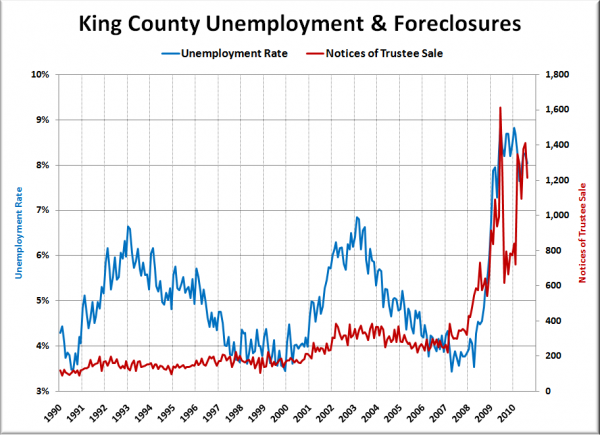

To close out the week, let’s have a look at a couple of factors that are continuing to drag the local housing market down: unemployment and foreclosures.

From 1990 through 2006, the average unemployment rate in King County was 4.9%. The unemployment rate is currently 8.0% (63% higher than the 1990-2006 average). Over that same period, there were an average of 203 notices of trustee sale each month. In August there were 1,214 NTSes (498% higher than the 1990-2006 average).

Let’s define a housing market “recovery” as a return to 2000-2003 average sales volume and a relatively consistent rate of appreciation between three and five percent a year.

Can a recovery really be just around the corner when unemployment and foreclosures are still as elevated as they are today? I’m inclined to say “not a chance.” Unless the magical pink ponies return to Seattle to start buying homes without the need for jobs or inventory stability, I think any real housing recovery here is at least a year or two away.

Big Picture Week on Seattle Bubble

- Case-Shiller HPI Rate of Increase

- Examining Home Affordability

- Price to Rent Ratio

- Price to Income Ratio

- Unemployment and Foreclosures