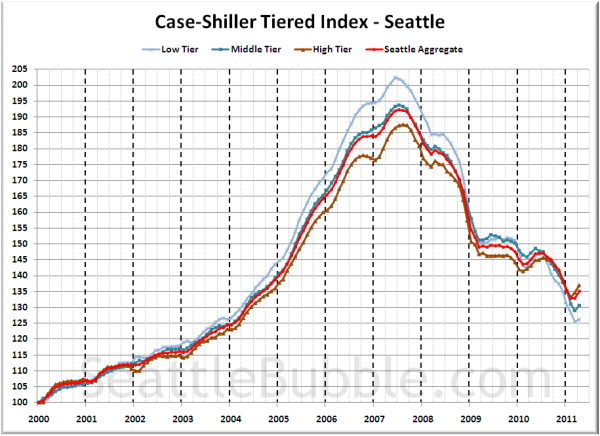

Let’s check out the three price tiers for the Seattle area, as measured by Case-Shiller. Remember, Case-Shiller’s “Seattle” data is based on single-family home repeat sales in King, Pierce, and Snohomish counties.

Note that the tiers are determined by sale volume. In other words, 1/3 of all sales fall into each tier. For more details on the tier methodologies, hit the full methodology pdf. Here are the current tier breakpoints:

- Low Tier: < $245,631 (up 1.7%)

- Mid Tier: $245,631 – $387,144

- Hi Tier: > $387,144 (up 1.7%)

First up is the straight graph of the index from January 2000 through April 2011.

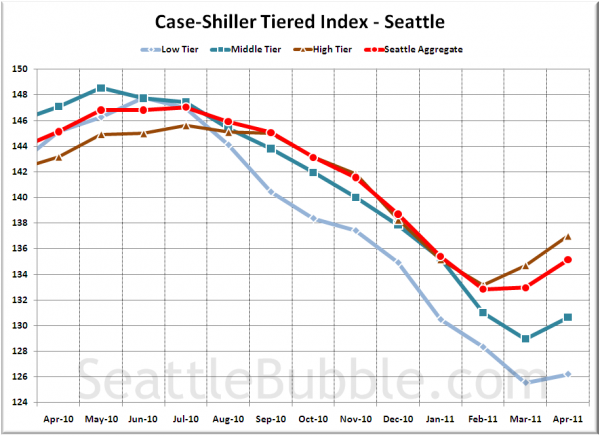

Here’s a zoom-in, showing just the last year:

Continuing the pattern that we have seen for the last few months, the low tier continues to show the most weakness, while the high tier comes out a bit stronger. The low tier rose just 0.5% MOM, the middle tier bumped up 1.3%, and the high tier gained 1.7%.

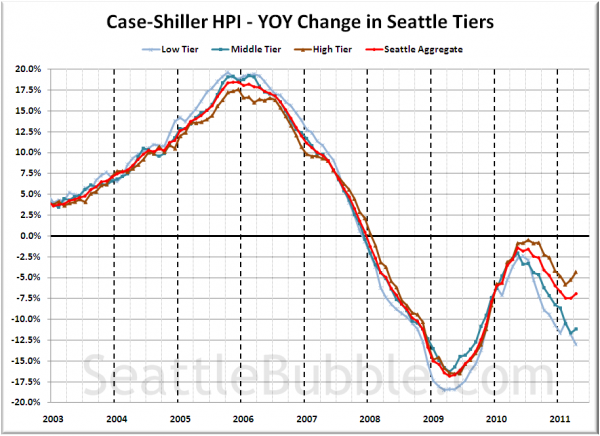

Here’s a chart of the year-over-year change in the index from January 2003 through April 2011.

With such a weak seasonal bump, the low tier increased its YOY losses, while the middle tier and high tier both marked improvements. Here’s where the tiers sit YOY as of April – Low: -13.0%, Med: -11.2%, Hi: -4.3%.

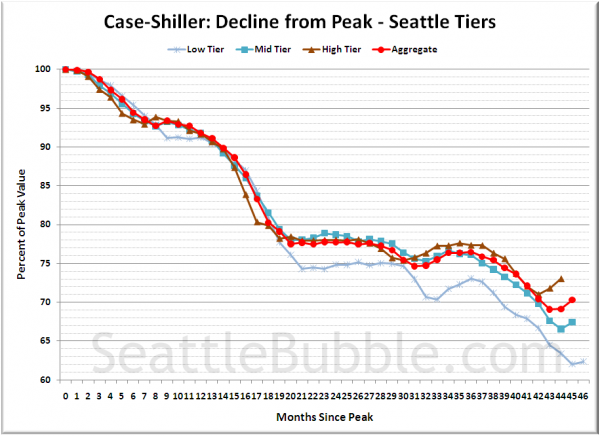

Lastly, here’s a decline-from-peak graph like the one posted yesterday, but looking only at the Seattle tiers.

Current standing is 37.6% off peak for the low tier, 32.6% off peak for the middle tier, and 27.0% off peak for the high tier.

(Home Price Indices, Standard & Poor’s, 06.28.2010)