Almost as soon as my mortgage was recorded in the public record, I started getting a delightful new breed of junk mail delivered to my home: Mortgage junk.

These particularly sleazy companies employ a number of really shady practices in thier mailings, including:

- Putting the name of my mortgage broker on the envelope

- Misleading phrases like “Payment Information Enclosed”

- Including details about my mortgage in their letter

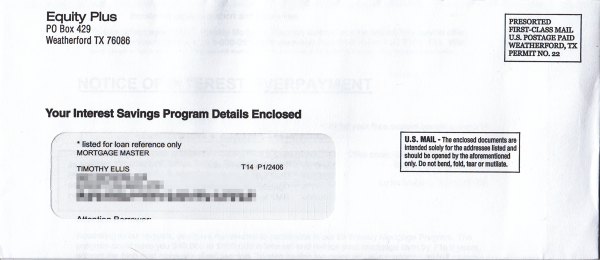

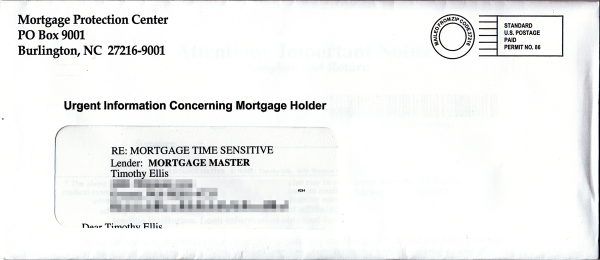

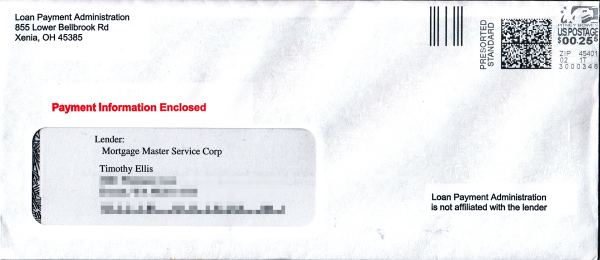

Here are some particularly eggregious examples I’ve received in the last few months. Click on the envelope to view the letter that was enclosed.

Oh boy! My interest savings program! The letter contains this delightful warning at the top: NOTICE OF INTEREST OVERPAYMENT Not misleading at all!

Ooh, it’s both “Urgent” and “Time sensitive”! Better open it right away! The letter in this one claims it is an “Important Notice” and demands that I “Complete and Return.” How about no.

These guys were the least sleazy of the bunch. At least they put it right on the envelope that they’re not actually affiliated with my lender. And in the letter they were nice enough to describe their service as an “Optional Payment Change.”

Fortunately my mortgage broker (Rhonda Porter with Mortgage Master Service Corp.) was proactive, warning me before I even finished signing all of my paperwork that these types of mailings would be coming my way, and were not actually coming from Mortgage Master.

If I didn’t have such a helpful broker or if I had been a more typical first-time buyer (one who hadn’t been studying the housing market for over six years) I might have easily been duped by one or more of these ploys.

How are these kinds of misleading solicitations even legal? Do you know anyone who has been duped into buying mortgage-related “services” that they don’t need by something like this? Curious to hear your thoughts.