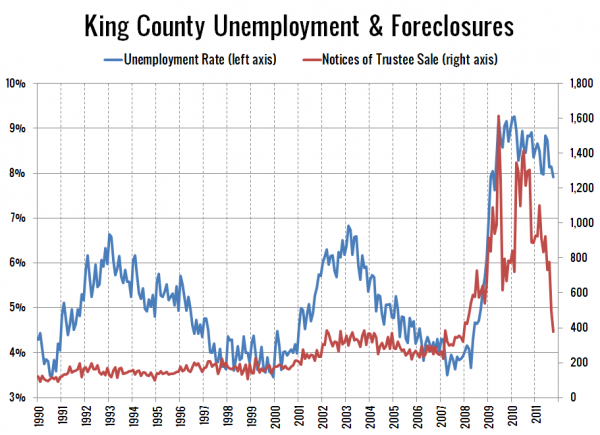

To close out the week, let’s take an updated look at a couple of factors that are continuing to drag the local housing market down: unemployment and foreclosures.

From 1990 through 2006, the average unemployment rate in King County was 4.9%. The unemployment rate is currently 7.9% (61% higher than the 1990-2006 average). Over that same period, there were an average of 203 notices of trustee sale each month. In November there were 421 NTSes (107% higher than the 1990-2006 average).

Foreclosures are down considerably from where they were over the last few years. I suspect this is largely due to legislation passed in Olympia earlier this year that has only served to lengthen the foreclosure pipeline, but even then, we’re still over double where one would expect the level to be in a “healthy” housing market. Plus, the unemployment rate is still far too high to be considered “healthy,” as well.

As I mentioned last year, as long as unemployment and foreclosures remain elevated (which they definitely still are), we’re not going to see a “recovery” in real estate. Expect both sales volumes and prices to be rolling along in the gutter for at least the next few years.

Big Picture Week on Seattle Bubble

- Case-Shiller HPI Rate of Increase

- Examining Home Affordability

- Price to Rent Ratio

- Price to Income Ratio

- Unemployment and Foreclosures