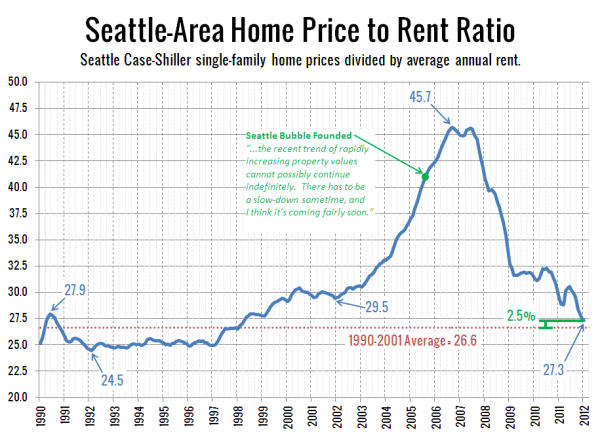

It’s been about a quarter of a year since we last checked in on the Seattle-area’s price to rent ratio, so I thought I’d share an update of those charts.

As of January (the latest Case-Shiller data available), Seattle’s price to rent ratio is down to just 2.5% above the 1990-2001 average, hitting its lowest point since Q1 1998.

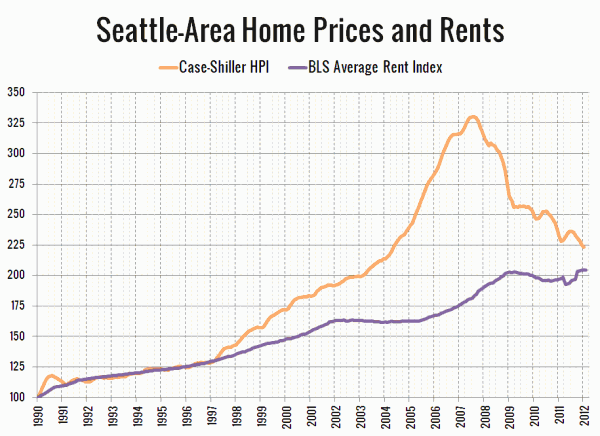

Here’s a different look at the same data, with prices and rents split up and each series indexed to January 1990 = 100 so you can see how each has been moving independently:

The difference between the price index and the rent index peaked at 83% in September of 2006. As of January, the price index sits just 9% above the rent index, the first time they have been within ten percent of each other since May 1998.

So, if you think Seattle homes were overpriced compared to local rents in 1998, then you probably think they’re still overpriced today. On the other hand, if you think that the economic fundamentals that I’ve been crowing about on this blog since I started it in 2005 are a good indicator of reasonable local home prices, perhaps you think that the era of overpriced Seattle homes is over.