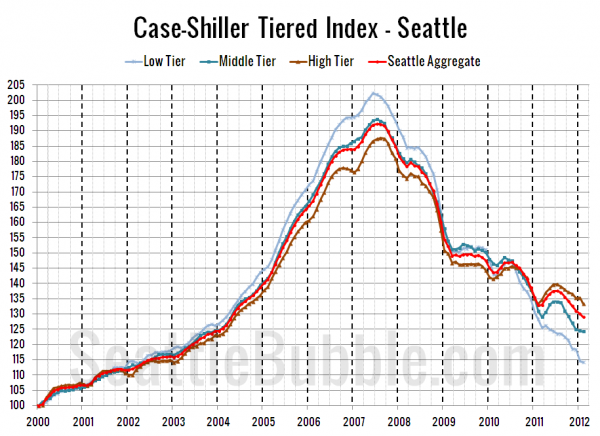

Let’s check out the three price tiers for the Seattle area, as measured by Case-Shiller. Remember, Case-Shiller’s “Seattle” data is based on single-family home repeat sales in King, Pierce, and Snohomish counties.

Note that the tiers are determined by sale volume. In other words, 1/3 of all sales fall into each tier. For more details on the tier methodologies, hit the full methodology pdf. Here are the current tier breakpoints:

- Low Tier: < $228,037 (down 0.8%)

- Mid Tier: $228,037 – $364,832

- Hi Tier: > $364,832 (down 1.2%)

First up is the straight graph of the index from January 2000 through February 2012.

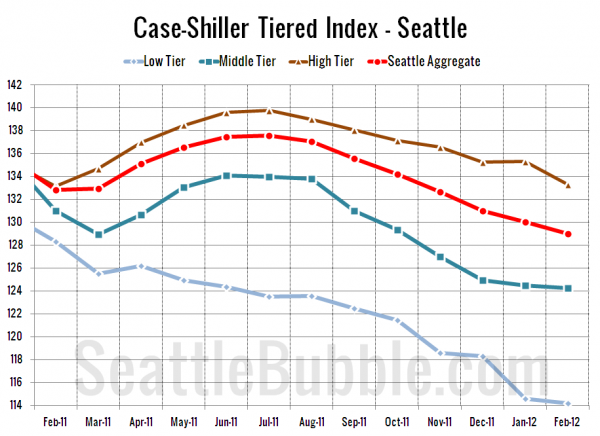

Here’s a zoom-in, showing just the last year:

All three tiers took a predictable seasonal dip between January and February. While the low and middle tiers both only barely declined, the high tier dragged down the combined index. The low tier fell 0.3% MOM, the middle tier dropped 0.2%, and the high tier lost 1.5%.

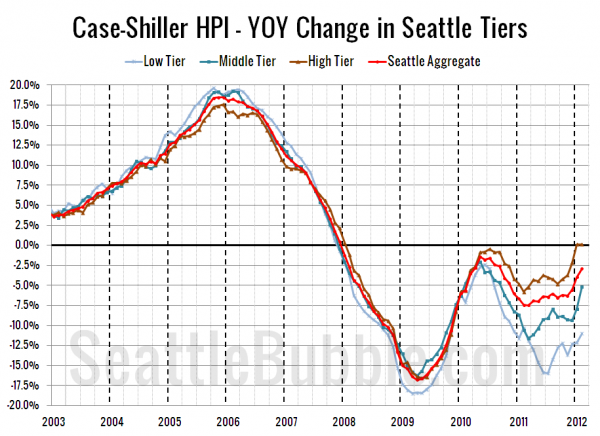

Here’s a chart of the year-over-year change in the index from January 2003 through February 2012.

Flat for the high tier, but a strong improvement on both the other tiers. Here’s where the tiers sit YOY as of February – Low: -11.0%, Med: -5.1%, Hi: +0.1%.

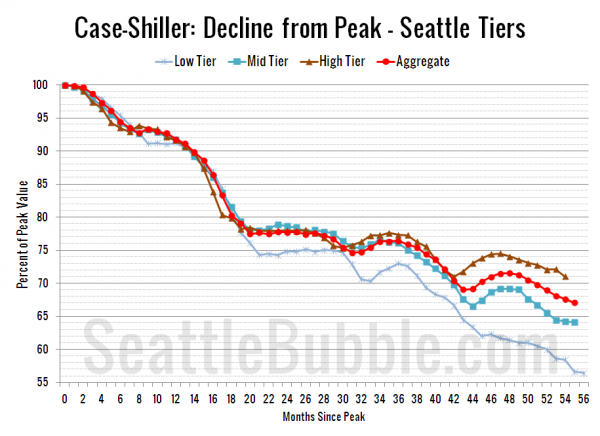

Lastly, here’s a decline-from-peak graph like the one posted yesterday, but looking only at the Seattle tiers.

Current standing is 43.6% off peak for the low tier, 35.9% off peak for the middle tier, and 28.9% off peak for the high tier. The middle and low tiers each set new post-peak low points, while the high tier remains just barely above its February 2011 low.

(Home Price Indices, Standard & Poor’s, 04.24.2012)